Latin America is one of the fastest-growing regions for iGaming, driven by a combination of strong demographic potential, accelerating digitalization, and the gradual legalization of gambling.

Latin America is one of the fastest-growing regions for iGaming, driven by a combination of strong demographic potential, accelerating digitalization, and the gradual legalization of gambling.

In 2024–2025, LatAm demonstrates steady growth: Brazil is completing a long-awaited regulatory reform, Colombia is reinforcing its status as a mature regulated market, Mexico is expanding its online segment, while Peru and Chile are moving toward updated regulatory frameworks. These developments create a rare window of opportunity for operators considering the launch of an online casino platform.

The key advantage of the region is scale. Latin America’s population exceeds 660 million people, with more than 70% of users actively making mobile payments and using digital wallets, making the market particularly receptive to online gambling.

An additional factor is the cultural familiarity with betting and instant entertainment: according to local regulators, in some countries up to 60% of adults participate in gambling activities at least once a year.

For entrepreneurs, this means access to a dynamic market where growing demand is not yet matched by intense competition — especially in the online casino niche. At a time when Europe is tightening controls and Asia remains regulatorily unpredictable, LatAm is emerging as one of the few regions where market entry can deliver sustainable returns when supported by the right entry model, casino platform, and online casino software.

Market size and iGaming dynamics in LatAm

According to the Blask Index (a metric of iGaming brand activity and user interest), the region recorded overall activity growth of more than 20% YoY in 2025. The fastest growth was seen in Mexico (+49%) and Chile (+34%), indicating a sharp rise in countries experiencing rapid digital adoption and increasing interest in online gaming.

These differences show that LatAm is not a single market but a collection of markets at different stages of maturity — ranging from fully regulated and mature environments to emerging markets where user activity and demand are only beginning to accelerate.

Why now is the right time to enter

-

Five-year projected GGR growth to over USD 12 billion, combined with active legalization in key countries, creates a competitive window for new operators.

-

In countries with established regulation, growth is less aggressive, but user behavior and audience size are stable, allowing for predictable revenue models.

-

In “emerging markets” (rapid activity growth, high mobile penetration, evolving regulations), there is an opportunity to enter early, secure market share, and build brand recognition before peak demand.

Overview of key Latin American markets

As noted, Latin America consists of countries with varying levels of iGaming maturity, diverse regulatory environments, and distinct user audiences. Below is an overview of the largest and most promising jurisdictions.

Brazil

Brazil is the largest market in the region, with a population exceeding 214 million people. According to Vixio forecasts, regulated online gambling GGR in 2025 is expected to reach approximately USD 2.9 billion, and exceed USD 6 billion by 2028 — accounting for more than half of the regional market.

The Brazilian government is finalizing the implementation of a federal licensing framework for online casinos and sports betting. Strict AML/KYC, marketing, and payment infrastructure requirements are being introduced, alongside active blocking of unregulated websites, accelerating player migration to licensed services.

Key characteristics:

-

Mobile traffic accounts for more than 80% of total activity.

-

International operators are actively forming partnerships with local brands through M&A.

-

Robust compliance infrastructure is required from day one of operations.

For operators prepared to invest in licensing, localization, and cooperation with an experienced igaming software provider, Brazil represents a strategically critical market with exceptional revenue potential.

Mexico

Mexico shows one of the highest growth rates in user activity — according to the Blask Index, brand activity increased by +49% YoY in 2025. The regulated online segment is estimated at USD 0.9–1.0 billion.

Mexico’s legislation is currently undergoing reform: federal regulations are being supplemented by local practices, resulting in a hybrid regulatory model.

Key characteristics:

-

A high proportion of mobile-first users.

-

Sports betting dominates, but the online casino segment is expanding rapidly.

-

Local e-wallets and fast payment methods are widely used.

Mexico is a high-growth market with strong potential, but regulatory volatility requires a flexible market entry strategy supported by scalable casino software and localized online casino software solutions.

Colombia

Colombia is the most mature regulated market in LatAm. The Coljuegos regulator provides transparent licensing procedures, clear taxation, and well-defined operational rules.

Key characteristics:

-

Balanced distribution between casino games and sports betting.

-

High user loyalty toward licensed brands.

-

Predictable growth without sharp fluctuations, delivering stable revenue.

Colombia is well suited for operators seeking stability, transparency, and predictable returns, particularly those working with established casino software providers and proven igaming software solutions.

Chile

Chile is in the process of developing legislation for online gambling. In 2024–2025, licensing bills are being discussed, but a fully implemented regulatory system is not yet in place.

Key features:

-

Rapidly growing user activity.

-

Most operators currently operate in a “grey zone”.

-

International brands are showing interest in securing early market positions.

Chile is a high-potential market but requires caution and a flexible strategy that takes future legislative changes into account.

Argentina

Argentina is a fragmented market where licensing is handled at the provincial level.

Key features:

-

Differences in taxes and operator requirements between provinces.

-

Stable user demand in regulated regions.

Entering the Argentine market requires a localized strategy focused on individual provinces.

Other promising markets

-

Peru — a developing market with increasing mobile internet penetration and digital payment adoption.

-

Uruguay — a small but regulated market, attractive for niche projects.

-

Panama — a stable jurisdiction with clear requirements, suitable for operators focused on predictable revenue and minimal regulatory risks.

Section summary:

Latin America is a collection of markets with varying levels of maturity and growth dynamics. The choice of country depends on the operator’s willingness to invest in regulation, infrastructure, and localization. At the same time, the region offers a rare opportunity to combine early market entry with the potential for significant revenue growth.

Regulation and legal requirements

The regulatory environment in Latin America remains heterogeneous, and understanding these differences is critical for the successful launch of an online casino. Overall, it can be divided into three models:

-

Mature regulated markets — examples include Colombia, Uruguay, and Panama. Licensing is transparent, operating conditions are clearly defined, fixed taxes are established, and AML/KYC and marketing rules are in place. These markets offer a predictable operating environment and minimize legal risks.

-

Provincial or fragmented model — Argentina. Licensing and taxation differ by province, requiring separate strategies for each jurisdiction and close interaction with local authorities.

-

Markets in the process of regulatory formation — Brazil, Mexico, and Chile.

In these countries, legislation is being introduced gradually:

- In Brazil — a national licence combined with blocking of unregulated operators;

- In Mexico — a mixed model of federal and provincial regulation;

- In Chile — draft laws are still under discussion.

For operators, this means the need for flexibility, readiness to adapt to changes, and continuous monitoring of legal initiatives in real time.

Key legal requirements to consider:

-

Licensing and registration: each country sets its own requirements for operators — from establishing a local legal entity to operating via a foreign brand representation.

-

AML/KYC: player identity verification and source-of-funds checks are mandatory in all regulated jurisdictions. Failure to comply may result in fines or platform blocking, regardless of whether the project is built on a proprietary casino platform, white label online casino, or turnkey online casino using online casino software from a gambling software provider.

-

Taxation: the tax burden varies significantly. In Colombia and Uruguay, fixed GGR-based rates apply, while in Brazil the tax structure is complex and differentiated by region.

-

Marketing and promotion: in mature jurisdictions, restrictions are imposed on advertising and affiliate operations; in emerging markets, the rules are often still being shaped during market development.

-

Responsible gaming: mandatory self-exclusion tools and protection mechanisms for vulnerable users are becoming the standard, especially within licensed segments of the online casino platform ecosystem.

Practical recommendations

-

Before launch, it is essential to conduct a comprehensive legal audit of the target country, including regional regulatory specifics.

-

Plan the budget taking into account licensing and tax costs, which may differ substantially across jurisdictions.

-

Build AML/KYC systems and payment infrastructure from the outset to avoid fines, account freezes, and operational disruptions within the casino software environment.

-

In countries with evolving regulation (Brazil, Mexico, Chile), it is crucial to monitor new legislative initiatives and remain prepared to adapt operating conditions.

Audience behavior and demand

Understanding audience characteristics is a key success factor for launching an online casino in LatAm. The market is defined by a combination of high mobile engagement, rapidly growing digital payment adoption, and a cultural affinity for gambling entertainment supported by modern igaming software.

Related reading: Casino target audience

Key audience characteristics:

-

Mobile-first audience:

In most LatAm countries, the share of users accessing platforms via mobile devices exceeds 80%, and in some segments reaches up to 90%. Smartphones are the primary channel for betting and playing at online casinos using online casino software.

-

Demographics:

The core active audience is aged 20–40, predominantly urban residents. This group actively seeks entertainment through mobile applications and social media, creating strong potential for digital marketing channels and cross-platform strategies within a casino online environment.

-

Game preferences:

-

Slots and live casino — the core areas of interest.

-

Sports betting — particularly popular in Mexico and Brazil.

-

Combined platforms (casino + sports betting) demonstrate the highest engagement and profitability, especially when powered by scalable gambling software.

-

-

Digital payments and habits:

Users активно rely on local e-wallets, bank transfers, and instant payment services. This reduces the time from first visit to first deposit and increases conversion rates. In several countries, cashless payments account for more than 70% of all deposits, which is critical for modern online casino platform operations.

-

Behavioral dynamics:

Players are becoming more selective and loyal to brands that offer a convenient interface, full localization, and transparent terms. Engagement growth is directly linked to UX quality, payment speed, and locally relevant content delivered through professional casino software providers.

Practical relevance for entrepreneurs:

-

Localization is critical: interface and content translation, local-language support, and region-specific games.

-

Mobile UX optimization: the platform must be fully optimized for smartphones, fast payments, and live gaming formats.

-

Interest-driven product selection: combined offerings (slots + live casino + sports betting) increase retention within turnkey casino solutions.

-

Focus on payment infrastructure: access to local e-wallets and instant transfers reduces churn and increases ARPU.

Section conclusion:

The LatAm audience is mobile, solvent, and inclined toward sustained online engagement. A successful launch requires a convenient, localized, and secure gaming experience, which directly impacts conversion rates, retention, and platform profitability when deploying professional online casino software.

Practical recommendations for entrepreneurs

Launching an online casino in Latin America requires a strategic approach that takes into account market specifics, regulation, and audience behavior, as well as the choice of a reliable gambling software provider.

Below are the key recommendations for operators planning to enter regional markets:

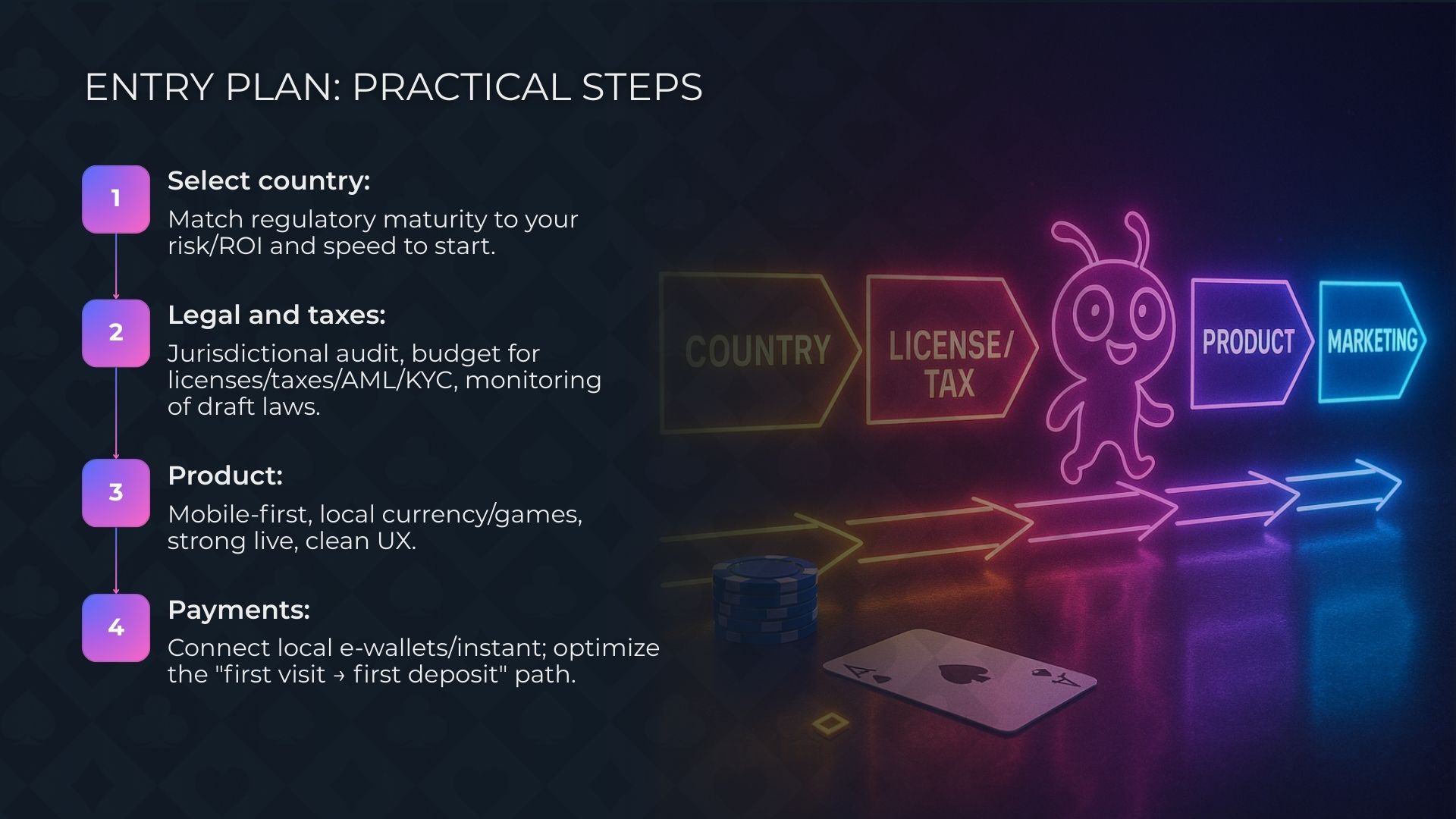

1. Country and jurisdiction selection

-

Assess regulatory maturity:

-

Mature markets (Colombia, Uruguay, Panama) offer stability and predictable returns for operators deploying online casino software.

-

Emerging markets (Brazil, Mexico, Chile) provide high growth potential but require flexibility and readiness for regulatory changes, especially for casino software providers entering early.

-

-

Segment the audience by country: consider demographics, mobile internet penetration, and local payment habits when building an online casino platform.

2. Legal and tax preparation

-

Be sure to conduct a legal audit of the country and regional regulatory requirements.

-

Plan the budget for licensing, taxation, and AML/KYC compliance, taking into account differences between countries and provinces.

-

In jurisdictions with evolving regulation, closely monitor new legislative initiatives and be prepared to adapt the business model of your casino online operation.

3. Product and localization

-

Interface and content localization: language, currencies, and locally relevant games.

-

Mobile-first platform: full adaptation for smartphones, live casino formats, and fast payment methods powered by modern igaming software.

-

Combined product offering: slots + live casino + sports betting increase engagement and profitability within a turnkey casino or white label online casino model.

4. Payment infrastructure

-

Integration of local e-wallets and instant top-up methods is a key retention factor for any online casino platform.

-

Optimizing conversion from first visit to first deposit reduces early-stage churn and improves overall performance of casino software.

5. Risk management and responsibility

-

Implement responsible gaming tools from day one.

-

Ensure full compliance with AML/KYC requirements to minimize legal and operational risks.

-

Establish transparent player rules and maintain brand trust, which is essential for long-term success with igaming software.

6. Strategic positioning

-

Plan an early market entry in emerging countries to secure a strong position before competition intensifies, especially when launching with a reliable gambling software provider.

-

In mature markets, focus on product quality, UX, and player retention — stable revenue is more important than rapid growth.

Section conclusion:

Success in the LatAm market requires a comprehensive approach: thorough legal preparation, product adaptation for the target audience and mobile environment, reliable payment infrastructure, and a market entry strategy aligned with regulatory maturity. Following these recommendations allows entrepreneurs to minimize risks and fully leverage the region’s potential.

Conclusion

Latin America demonstrates a unique combination of growing demand, high mobile engagement, and active legalization of online gambling. The market is heterogeneous: mature jurisdictions such as Colombia and Uruguay offer a predictable environment and stable revenue, while emerging markets — Brazil, Mexico, and Chile — provide opportunities for early entry and rapid scaling of online casino platforms.

Key factors for a successful online casino launch remain:

-

deep understanding of the regulatory environment and timely compliance with legal requirements;

-

product adaptation to the local audience with mobile-first UX, localized content, and flexible payment infrastructure;

-

strategic choice of market entry model — early capture in emerging jurisdictions or stable operations in mature markets;

-

risk management, including AML/KYC compliance and responsible gaming tools.

The region offers a rare opportunity to combine high growth with relatively low market saturation. Entrepreneurs who accurately assess risks, localize their products, and build an efficient operational structure will gain a long-term competitive advantage and maximize profitability from the rapidly developing Latin American online gambling market.