Despite worrying economic signals and a possible slowdown in 2025, major Las Vegas casino operators are delivering impressive results.

This is particularly important for those planning to launch an online casino or seeking resilient casino programs capable of withstanding any crisis.

The results of Q1 2025 speak for themselves: revenues and margins remain strong, advance bookings are stable, and digital channels are showing double-digit growth rates. This is a signal not only for investors but also for entrepreneurs considering their own start in the gambling industry.

A Strong Quarter Amid Turbulence

The largest U.S. casino companies, including MGM Resorts, Caesars Entertainment, Boyd Gaming, and Red Rock Resorts, reported results that exceeded analyst expectations. Particularly notable are EBITDA figures, achieved through strict cost discipline and strategic management.

EBITDA is a financial metric reflecting a company’s earnings before interest, taxes, depreciation, and amortization. In the gambling industry, EBITDA helps compare companies with different cost structures and debt loads — for example, showing how efficiently an online casino operator performs regardless of its debt or tax jurisdiction.

-

MGM reported $1.181 billion EBIDTAR on $4.28 billion in revenue — above Bank of America’s forecasts.

-

In Las Vegas, the company recorded record-breaking revenues from rooms and gaming halls in April.

-

In Asia, MGM China generated $286 million in EBITDA — well above expectations.

-

BetMGM’s online division recorded a 68% increase in net revenue — mainly due to reduced marketing expenses.

Caesars, meanwhile, posted $884 million in EBITDA and steady revenue of $2.79 billion:

-

In Las Vegas, EBITDA reached $433 million on $1 billion in revenue.

-

Regional operations delivered $440 million in EBITDA.

-

The Caesars Digital division showed a jump in EBITDA to $43 million (vs. $5 million a year earlier), with igaming up 40% and net online gaming profit up 70% in April.

Online Business as a Growth Engine

The growth of the iGaming segment is particularly telling. Caesars’ online casino revenue rose by 70% in April, while MGM’s net revenue from online sports betting grew by 68% year-over-year. This proves that a telegram casino bot or a full-scale casino platform can be a highly profitable investment.

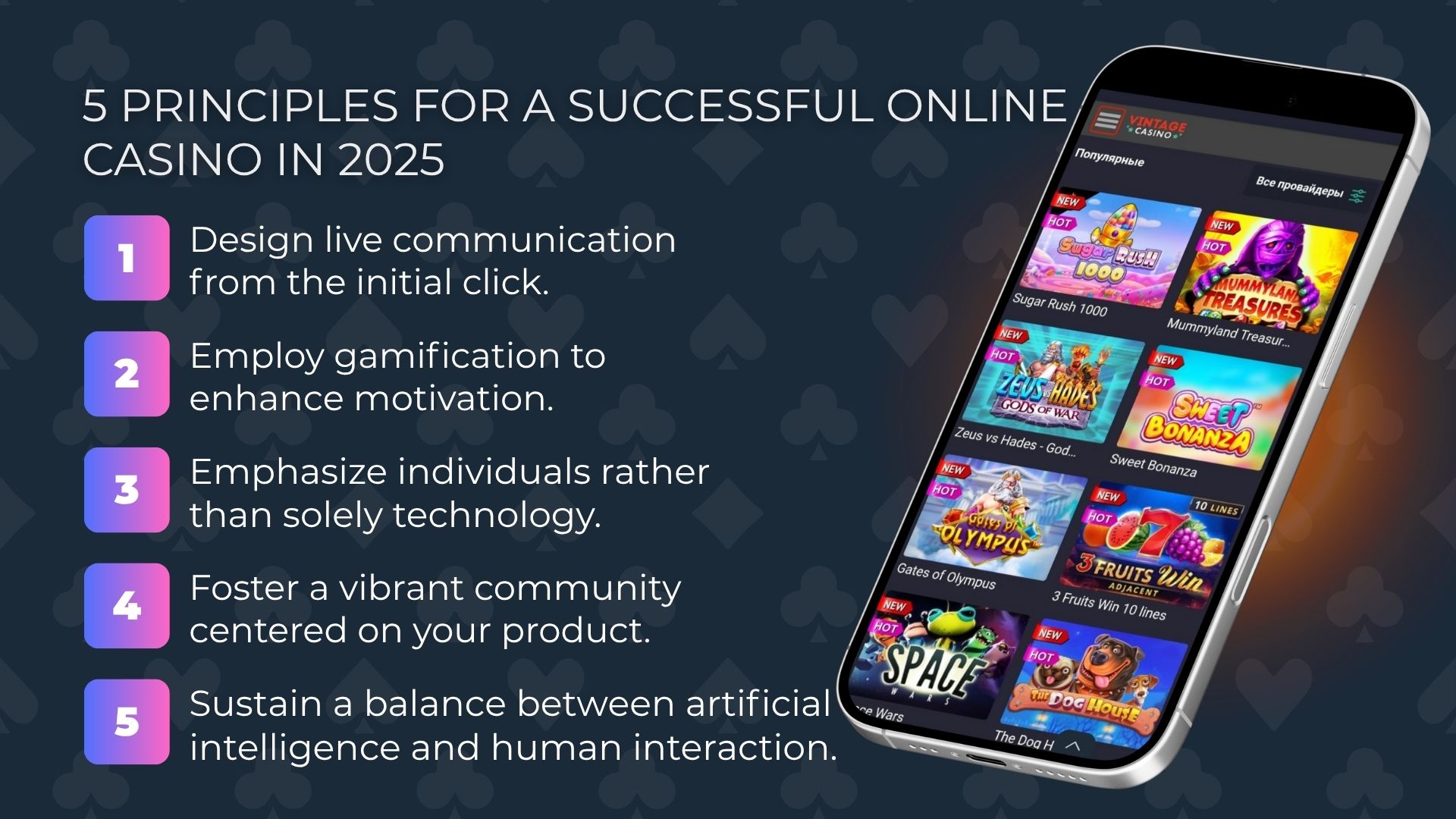

If you are planning to launch an online casino, note that the digital segment is currently the most flexible and potentially profitable. However, such projects require solid legal assessment and a well-thought-out scaling model, especially when operating in grey jurisdictions.

Lessons for Future Online Casino Operators

1. Resilience is a Strategy

MGM and Caesars executives see no alarming signs of weakening demand. Instead, they focus on cost discipline, booking optimization, and revenue diversification, including digital platforms.

“Even with lower betting volumes, Caesars focuses on profitable customers, retention, and reduced promotional spending,” notes a Bank of America analyst.

2. Digital is the Growth Driver

Caesars and MGM are actively investing in digital. BetMGM and Caesars Digital demonstrate how smart cost optimization and targeting can deliver profitability even amid declining bets.

Notably, Caesars grew its igaming revenue by 40% compared to industry growth of 27%, while net income rose 70%.

3. Flexibility and Partnerships

MGM is strengthening its position not only in the U.S. but also in Asia, where it has increased investments in its Osaka project (up to $700 million annually). In the U.S., the company is leveraging its partnership with Marriott (Bonvoy), which helps maintain demand among high-value customers.

Why This Matters for Those Who Want to Launch Their Own Online Casino

- Digital gambling growth shows no signs of slowing. With the right strategy, profitability is possible even amid declining betting volumes.

- Promotional budgets can be reduced by focusing on retention, segmentation, and cost optimization.

- A multi-brand strategy, like Caesars’, enables coverage of different audiences and market share growth.

- A regional approach works: even in unstable times, steady local demand supports revenue.

Conclusion

The results of MGM and Caesars prove that even in times of economic uncertainty, a well-run gambling business can not only survive but grow. The focus is on cost management, revenue diversification, digital investments, and audience engagement.

If you are planning to launch an online casino, take inspiration from the leaders. Analyze consumer behavior, invest in retention, test channels, and build systems. Today, digital gambling is a highly competitive business, but it also offers enormous potential for those who think strategically.