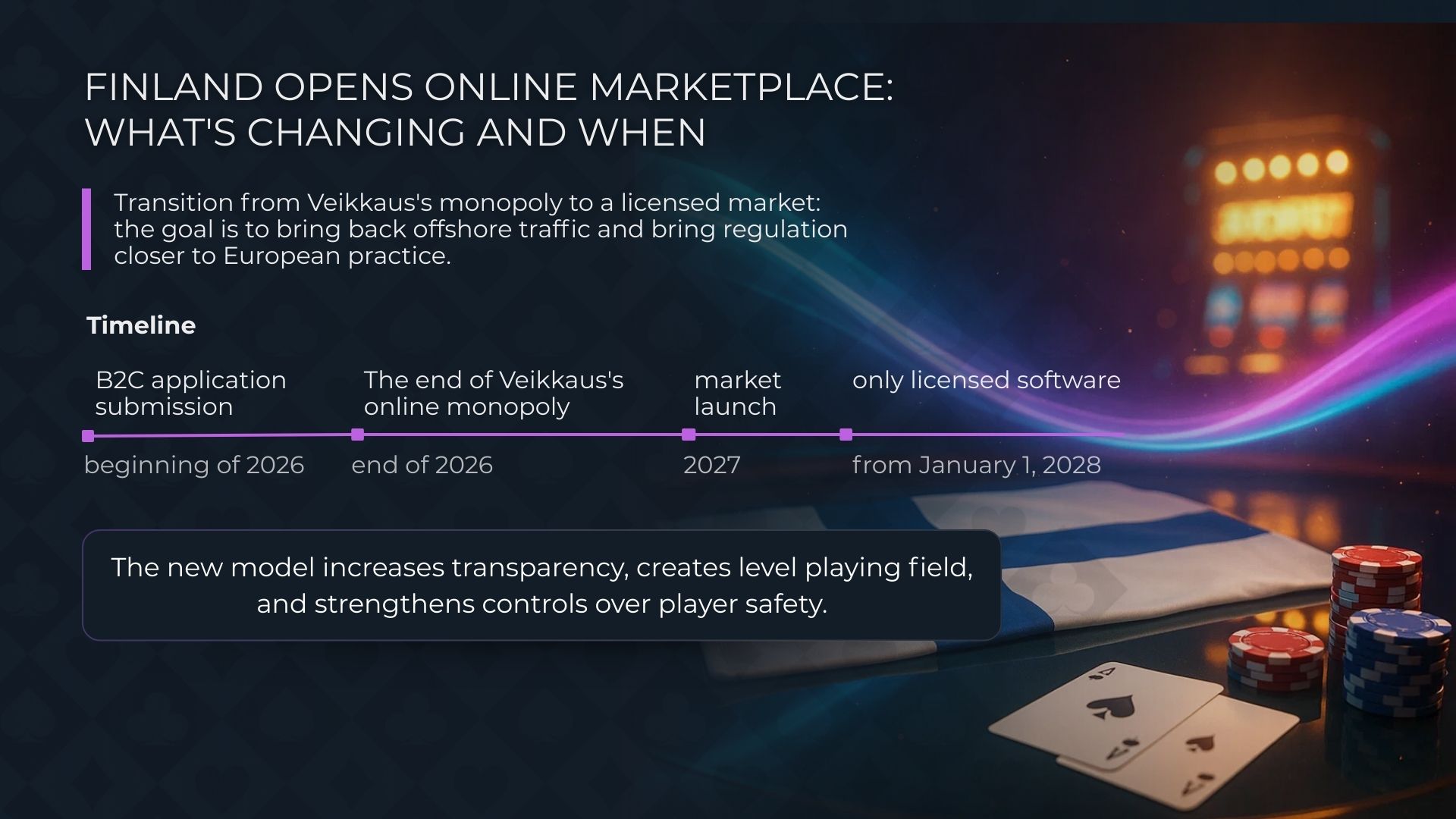

Finland is completing its transition from a closed monopolistic model to a regulated market system open to private operators. The changes primarily affect the online segment: the state-owned operator Veikkaus will lose its exclusive right to online casino operations and betting by the end of 2026. This decision is a logical result of the declining effectiveness of the monopoly and the growing volume of traffic migrating to foreign platforms.

The shift to a licensing framework was also driven by the need to harmonize national regulation with European practices and to create conditions under which the state can effectively regulate the market rather than compete with illegal operators.

The opening of the market in 2027 is expected to create a more transparent and manageable environment, where uniform rules apply to all participants and requirements for player protection and financial security are fully taken into account.

|

Stage |

Deadline / Date |

|---|---|

|

End of Veikkaus’ monopoly on online gambling |

End of 2026 |

|

Start of applications for B2C casino licences |

Early 2026 |

|

Submission of applications for B2B licences |

2026–2027 |

|

Mandatory use of licensed software |

1 January 2028 |

|

Opening of the new market to operators |

2027 |

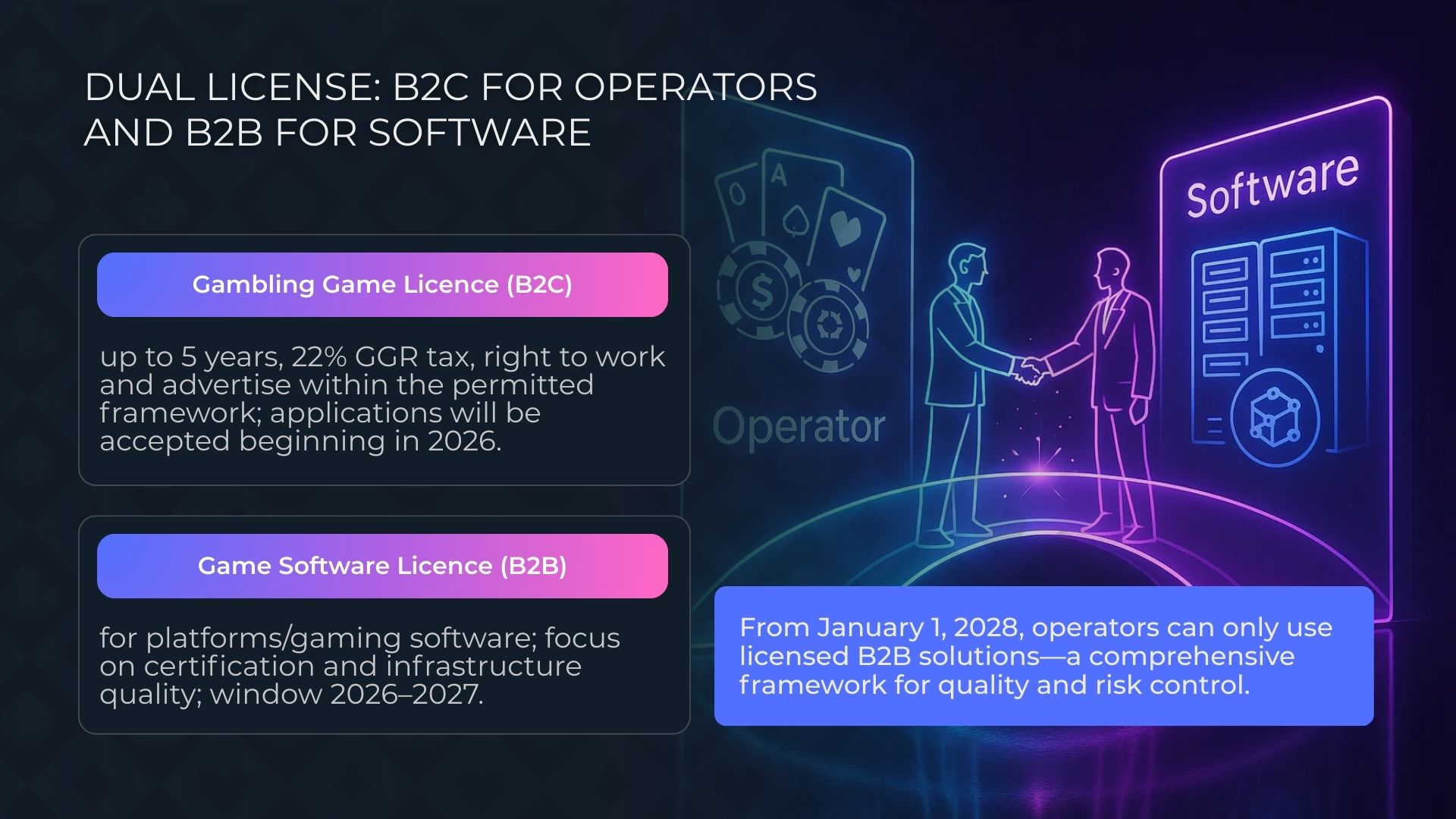

New Model: Dual Licensing Structure

The upcoming reform provides for a transition to a system in which regulation covers both operators and technology suppliers. To achieve this, two types of licences are being introduced, forming a unified framework for controlling online gambling, online casino software, and casino platforms.

Gambling Game Licence is intended for operators offering online casinos and betting services. It grants the right to operate on the Finnish market, advertise within permitted limits, and integrate local payment solutions. The licence is issued for a period of up to five years, and operators’ activities are taxed at a rate of 22% of gross gaming revenue (GGR). Applications for this type of licence will open in early 2026, giving companies sufficient time to prepare internal processes and ensure compliance with regulatory requirements applicable to online casino platforms.

The second element of the model is the Game Software Licence, which is mandatory for B2B providers of platforms, game solutions, and technological infrastructure, including any gambling software provider or igaming software provider. This licence establishes a mechanism under which the entire market will operate on certified and verified casino software. By 2028, operators will be able to use only those solutions that have undergone licensing, ensuring that online casino software and igaming software meet regulatory standards, minimizing technological risks, and strengthening quality control.

The introduction of a two-tier licensing system enables the state to legalize a significant share of online activity, ensure transparency in the supply of software, and establish unified security standards for all market participants, including casino software providers and online casino platforms.

|

Parameter |

Gambling Game Licence (B2C) |

Game Software Licence (B2B) |

|---|---|---|

|

Intended for |

Online operators (casinos, betting) |

Platform and gaming software providers |

|

Validity period |

Up to 5 years |

Up to 5 years |

|

Tax / fee |

22% GGR |

Not subject to GGR tax, licence is mandatory |

|

Start of application period |

Early 2026 |

Stage following B2C, 2026–2027 |

|

Mandatory requirement |

Operation exclusively with licensed software (from 2028) |

Compliance with quality standards and certification |

|

Purpose |

Regulated market access for operators |

Quality control of technological infrastructure |

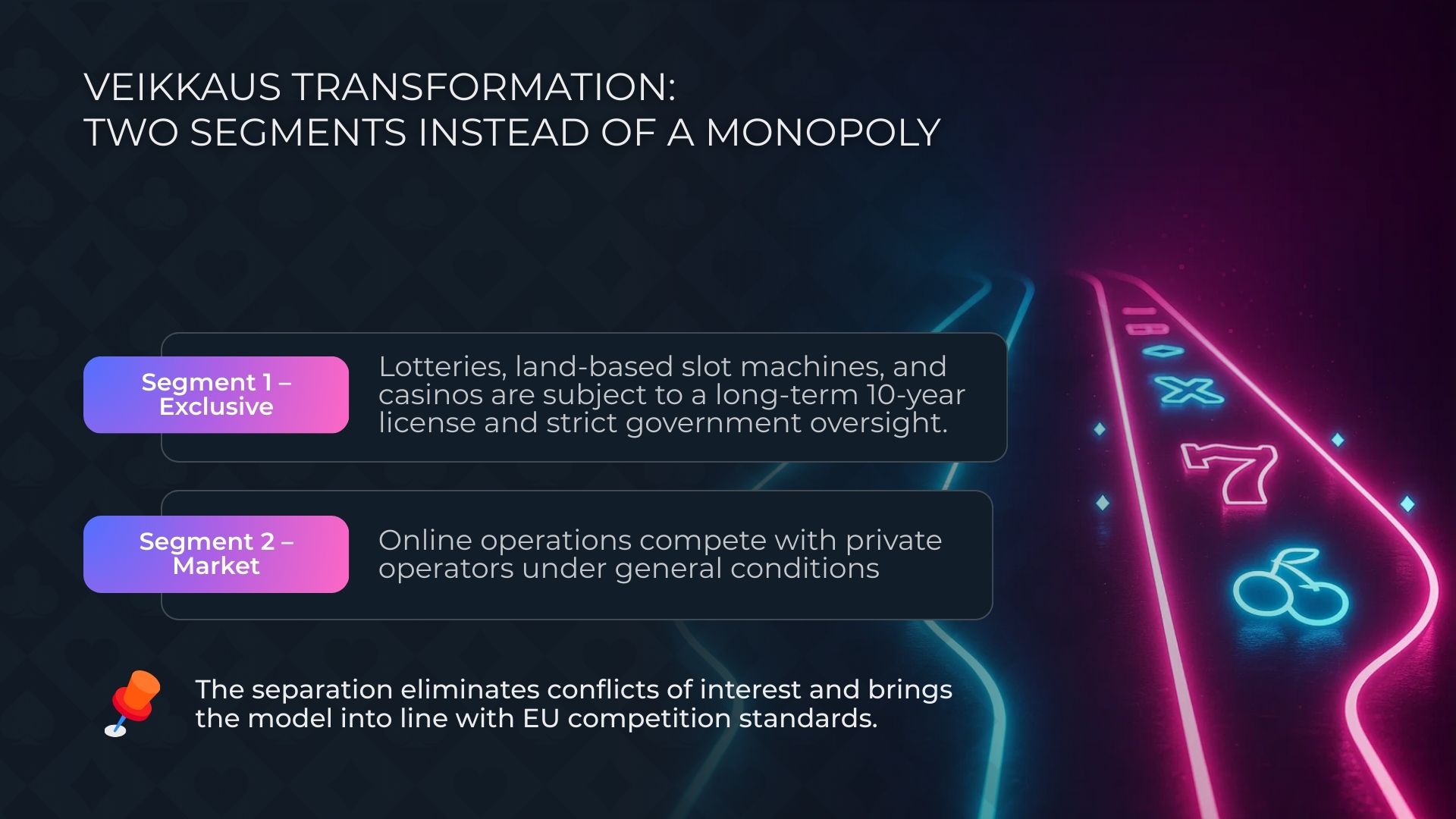

Transformation of Veikkaus: Two Segments Instead of a Single Monopoly

The state-owned operator is undergoing a profound restructuring process: instead of a single vertically integrated company, two independent legal entities are being established, each with distinct objectives and different levels of regulatory oversight.

The first segment retains its status as an exclusive operator. It receives a long-term ten-year licence covering lotteries, land-based slot machines, and terrestrial casinos. These areas remain under strict state control, allowing Finland to maintain high standards of responsible gambling and transparency.

The second segment begins operating under a market-driven model. It enters the online sector as a commercial operator and will compete on equal terms with private companies that, for the first time, are granted the opportunity to operate legally in the country. This implies a different licensing regime, a more flexible product strategy, and a direct dependence of performance on the quality of digital services, including the casino platform and online casino software used.

This dual-track structure was necessary to align the regulatory system with EU competition requirements and to eliminate the conflict of interest that arose when Veikkaus simultaneously acted as both a monopolist and a regulator of the online gambling market. The separation model makes it possible to establish transparent rules for all participants and create conditions for the development of a fully licensed market, in which every gambling software provider, igaming software provider, and casino software supplier operates under uniform standards.

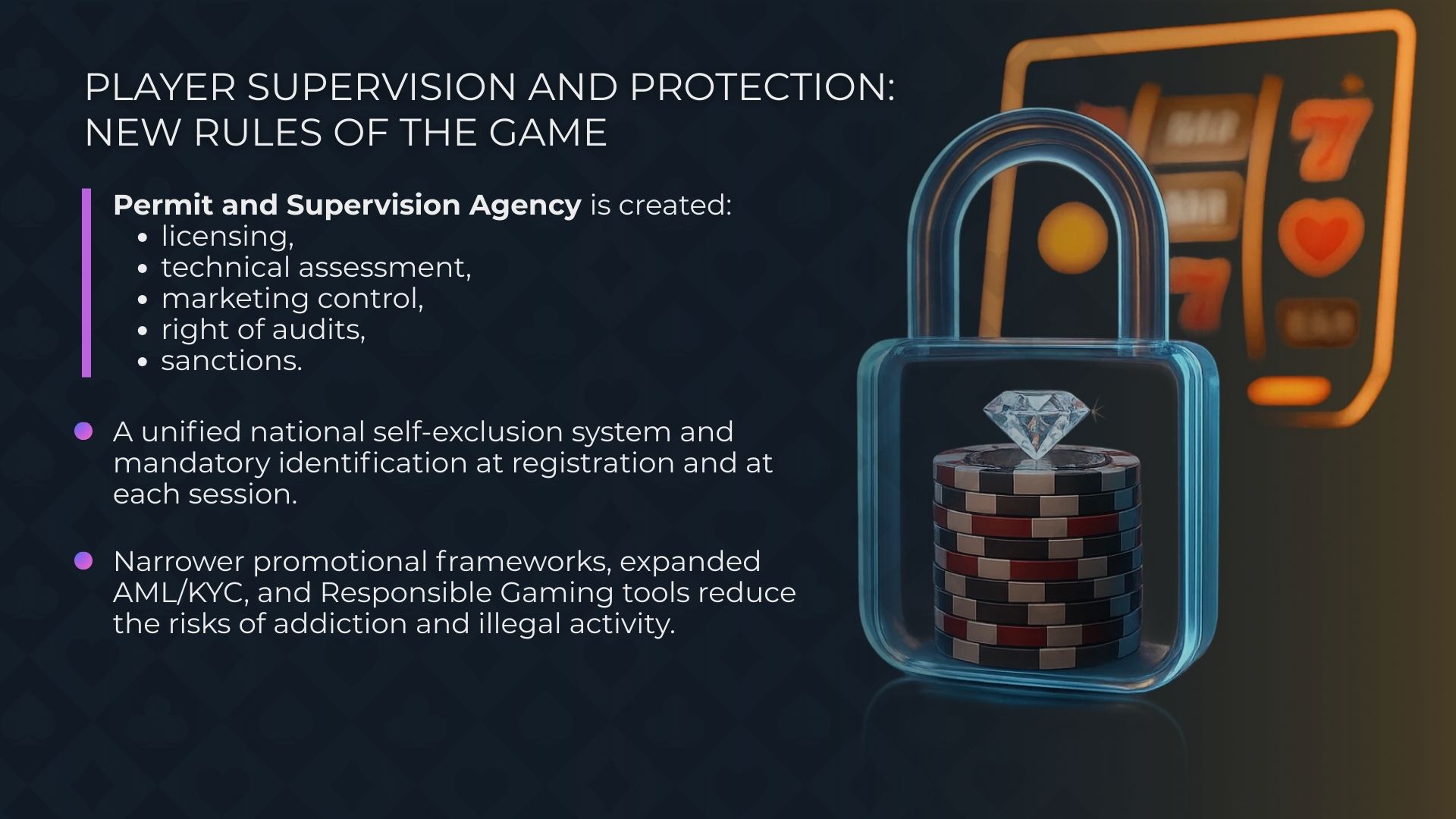

Regulation, Supervision, and Player Protection

The reform is accompanied by the establishment of a new supervisory authority — the Permit and Supervision Agency, an independent body that assumes key licensing and control functions. Its mandate covers the full regulatory cycle: from issuing licences and assessing technical solutions to monitoring marketing activities and verifying compliance with AML/KYC requirements. The agency is empowered to initiate audits, impose sanctions, and suspend operators’ activities in the event of violations.

As part of player protection measures, a unified national self-exclusion system is being introduced, mandatory for all market participants. It integrates both the land-based sector and online operators, providing a universal mechanism for restricting access to gambling. User identification becomes mandatory at all stages — from registration to each gaming session — enhancing the accuracy of age and financial checks.

In addition, the scope of marketing activities is being narrowed: restrictions are introduced on the format and frequency of promotional materials in order to reduce pressure on vulnerable player groups. Operators are required to implement enhanced responsible gambling tools, including behavioral monitoring, early risk detection, and timely interventions.

This set of measures is aimed at reducing the risk of gambling addiction, creating barriers for illegal operators, and increasing overall market transparency. The new model strengthens trust in licensed platforms, including any online casino platform, and establishes unified safety standards for the entire industry.

Opportunities and Challenges for Entrepreneurs and Operators

The opening of the market creates favorable conditions for international operators and technology companies ready to operate within a transparent regulatory framework. Finnish audiences traditionally demonstrate a high level of engagement with digital gaming products, while trust in public institutions and regulated services increases the likelihood of stable growth following the launch of the new licensing system. The legalization of the online segment and the introduction of competition are expected to accelerate local market development and generate demand for high-quality products and innovative solutions, including modern casino platforms and online casino software.

Alongside these opportunities, new requirements are emerging for market participants. Operators must comply with updated technological standards, ensure integration with certified solutions, and work exclusively with licensed B2B providers, such as a gambling software provider or igaming software provider. The tax rate and marketing restrictions require a well-considered financial and promotional strategy, while stricter player verification rules necessitate a robust infrastructure for reliable KYC processes.

For entrepreneurs, this is a period of preparation. It is already essential to audit potential partners, assess platform readiness for the 2027–2028 requirements, and build a technical stack that takes future B2C and B2B licences into account. Early alignment of internal processes, compliance with security standards, and proper implementation of identification procedures will allow companies to enter the market without delays and minimize operational risks, whether launching a proprietary solution or a white label online casino.

Conclusion: How to Prepare for the 2027 Market Launch

The reform being implemented by Finland will become one of the most structurally significant changes in the European iGaming sector. The transition from a monopoly to a dual licensing model reshapes the rules of market participation and creates conditions in which competitiveness is determined by technological quality, process reliability, and regulatory compliance. For businesses, this is a moment when strategic decisions made over the next two years will directly influence their position within the new ecosystem.

Companies planning to enter the market need to adopt a systematic approach to preparation. First and foremost, this involves monitoring regulatory developments, draft regulations, and the timeline for the rollout of individual reform elements. In parallel, businesses should develop a licensing strategy that includes cost assessment, potential risks, and partner requirements. A critical step will be the creation of a detailed roadmap — from selecting a casino software solution or turnkey casino platform and vetting casino software providers to implementing responsibility mechanisms, AML/KYC procedures, and marketing compliance controls.

Market development scenarios will depend on the speed of operator adaptation, the level of competition, and Veikkaus’ readiness to operate under the new conditions. With proper preparation, participants will be able to secure stable positions at the market opening stage, while companies with an innovative approach can gain an advantage through flexibility and advanced technology. The new regulatory model makes the Finnish market attractive for those willing to invest in security, quality, and long-term operational solutions, whether through proprietary development or a turnkey online casino model.