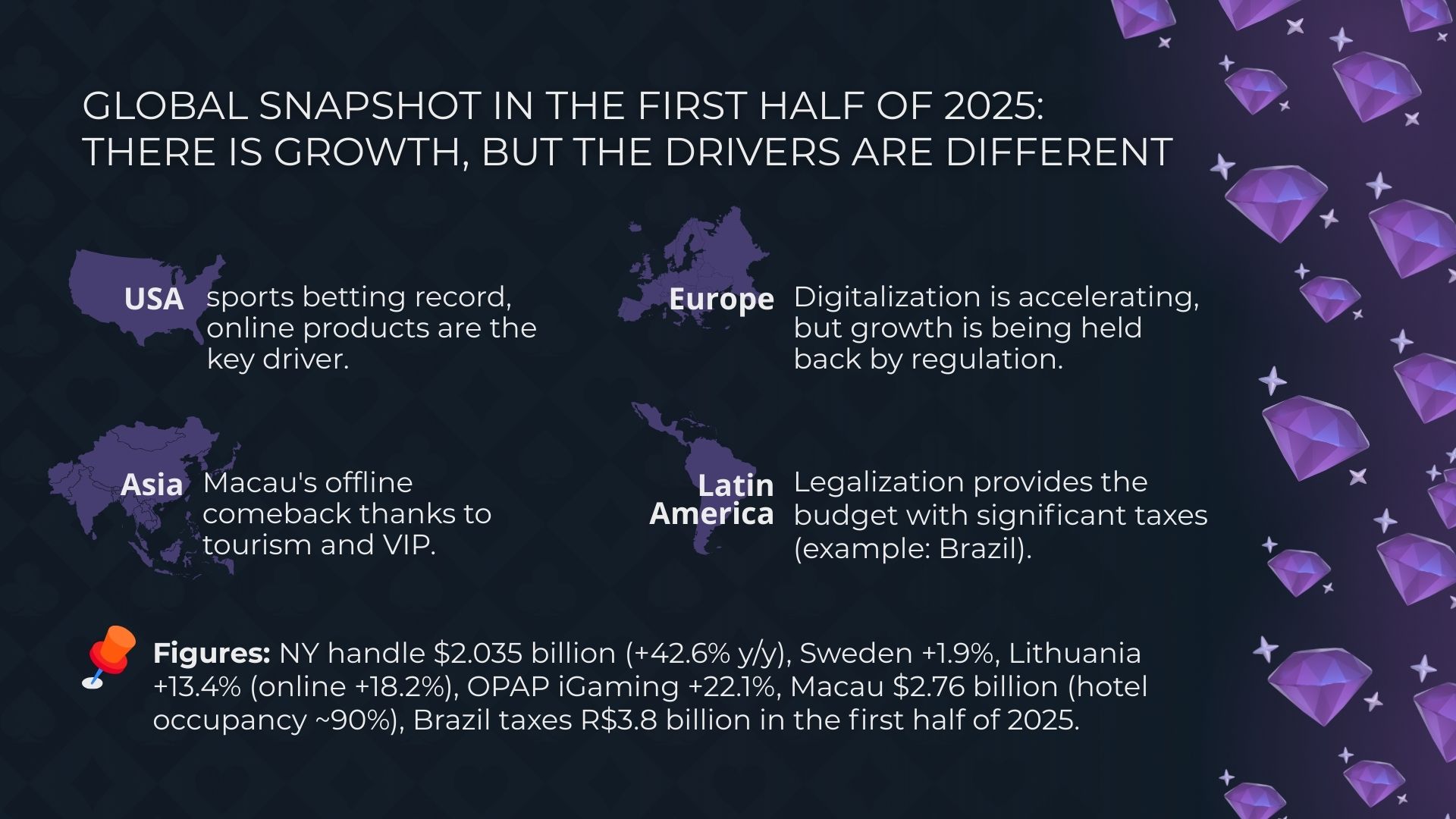

The first half of 2025 confirms the steady growth of the global gambling market, but the nature of this growth varies significantly across regions.

The first half of 2025 confirms the steady growth of the global gambling market, but the nature of this growth varies significantly across regions.

In the United States, for example, sports betting in August reached $2.035 billion, up 42.6% year-on-year, while casinos generated $65 million in revenue (+4.7% y/y), with slots dominating and table games showing a decline.

In Europe, Lithuania reported a 13.4% increase in revenues, with the online segment up 18.2%. Meanwhile, OPAP in Greece boosted its iGaming revenue by 22.1%, reflecting the effectiveness of a diversified strategy. By contrast, Sweden’s growth was limited to just 1.9%, reflecting the impact of stricter regulatory policies and the closure of land-based casinos.

In Asia, Macau regained its leadership in the land-based segment: $2.76 billion in revenue, 90% hotel occupancy, and a revival of tourism make this market an example of successful post-pandemic recovery.

The data from New York, Sweden, Lithuania, Greece (OPAP), and Macau illustrate how revenue sources differ and what challenges the industry faces.

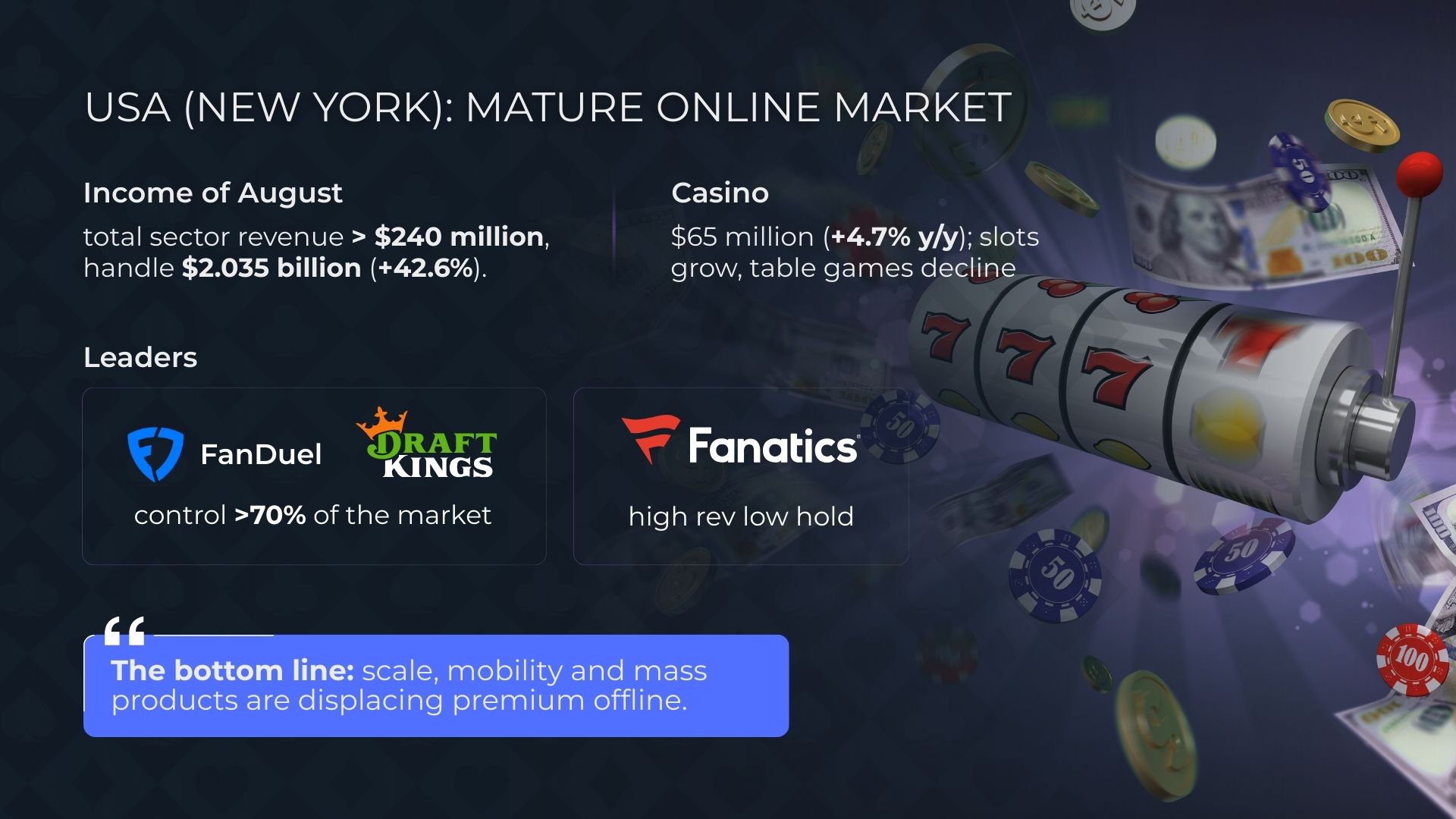

New York strengthens its gambling market leadership

August 2025 set a record for New York’s gambling sector. Total gambling revenue exceeded $240 million, and sports betting volume reached $2.035 billion, which is 42.6% higher than in August 2024. This growth was fueled by an increase in active players, the expansion of mobile casino platform offerings, and competition between major operators — FanDuel and DraftKings, which together control more than 70% of the sports betting market.

Interestingly, Fanatics Sportsbook, despite recording a turnover peak, showed a low hold rate, pointing to profitability issues: high turnover does not always translate into profits.

In the casino segment, revenues reached $65 million, up 4.7% y/y. Slots were the main growth driver, while table games declined, reflecting a shift in player preferences toward simpler, mass-market gambling software products.

Thus, New York demonstrates a mature market where digitalization and mass-market products are the primary revenue drivers, while premium land-based segments are gradually losing share. These trends create a context for comparison with European and Asian markets, where revenue dynamics differ substantially.

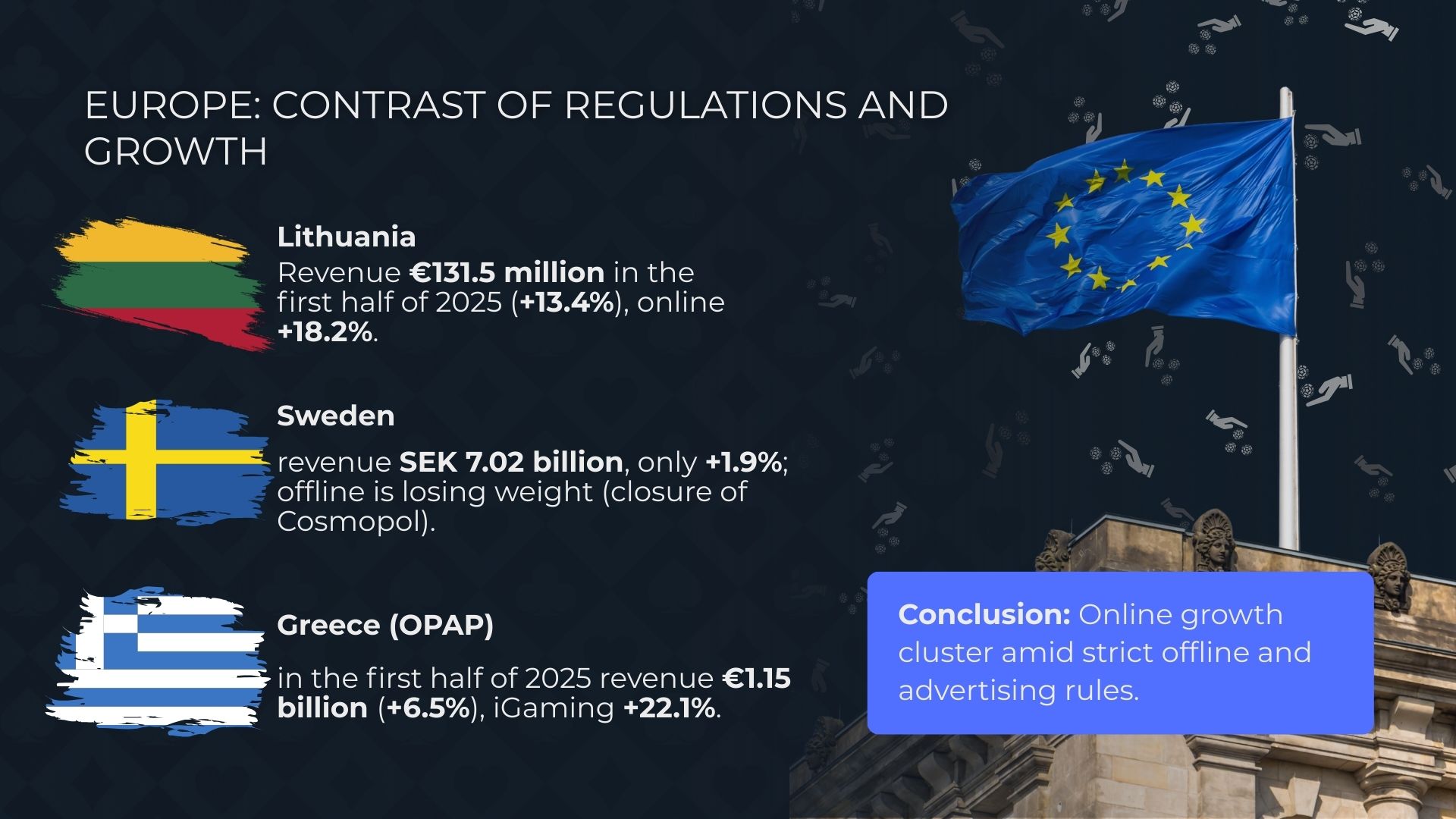

Europe: digitalization grows amid regulatory constraints

The European gambling market shows mixed dynamics. The main drivers remain online casinos and betting, while land-based sectors face restrictions due to tighter regulation.

Sweden: moderate growth and offline decline

In Q2 2025, Sweden’s gambling market revenues amounted to SEK 7.02 billion, 1.9% higher y/y. The main contributors were online games and lotteries, while land-based casinos continue to lose relevance. The closure of the national casino Cosmopol reflects this trend: traditional offline formats are gradually giving way to online casino platforms.

Strict regulatory policies, including advertising restrictions and responsible gambling measures, are slowing growth but making the market more transparent and predictable for the state.

Lithuania: rapid online segment growth

The Lithuanian market generated €131.5 million in H1 2025, 13.4% higher y/y. The biggest growth came from online casinos (+18.2%), while land-based casinos added 7%.

Regulatory changes, including a ban on gambling advertising and a higher minimum age requirement, may constrain further growth. However, digitalization and mobile iGaming software continue to support positive market momentum.

Greece (OPAP): stable growth through diversification

OPAP reported €1.15 billion in H1 2025 revenue, up 6.5% y/y. The main driver was iGaming (+22.1%), with lotteries and sports betting also showing positive dynamics.

Such a multichannel model makes OPAP an example of a sustainable strategy in a market where the growth of certain segments can offset the slowdown of others. This demonstrates that diversification remains key to resilience under stricter regulations.

Overall, Europe demonstrates a trend toward digitalization and operator adaptation to new rules, forming a unique contrast with the United States, where growth is fueled by mass sports betting and digital platforms, while offline casino software providers remain stable.

Macau consolidates leadership in land-based gambling

August 2025 further confirmed Macau’s recovery as the global hub of land-based gambling. Revenues totaled $2.76 billion, 12.2% higher y/y, marking the best performance of 2025.

Growth drivers

-

Tourism and hotel occupancy: average occupancy exceeded 90%, reflecting the recovery of international travel, particularly from China and other Asian countries.

-

Integrated resorts: the development of large-scale hotel and entertainment complexes generates additional revenue from non-gaming services, including restaurants, shopping, and entertainment.

-

Major events: sports and cultural events attract both players and tourists, boosting overall casino attendance.

Revenue structure

-

Slots and electronic games remain the main revenue stream.

-

Table games are growing, especially in the VIP segment, which generates a significant portion of profits.

-

Additional services (restaurants, shows, accommodation) contribute up to 15% of resort revenues, strengthening operator resilience.

Macau remains the center of land-based gambling, with tourism and premium players as the main drivers.

Thus, Macau serves as an example of a successful land-based market recovery, confirming that integrating entertainment, hospitality, and gaming creates a sustainable business model for operators.

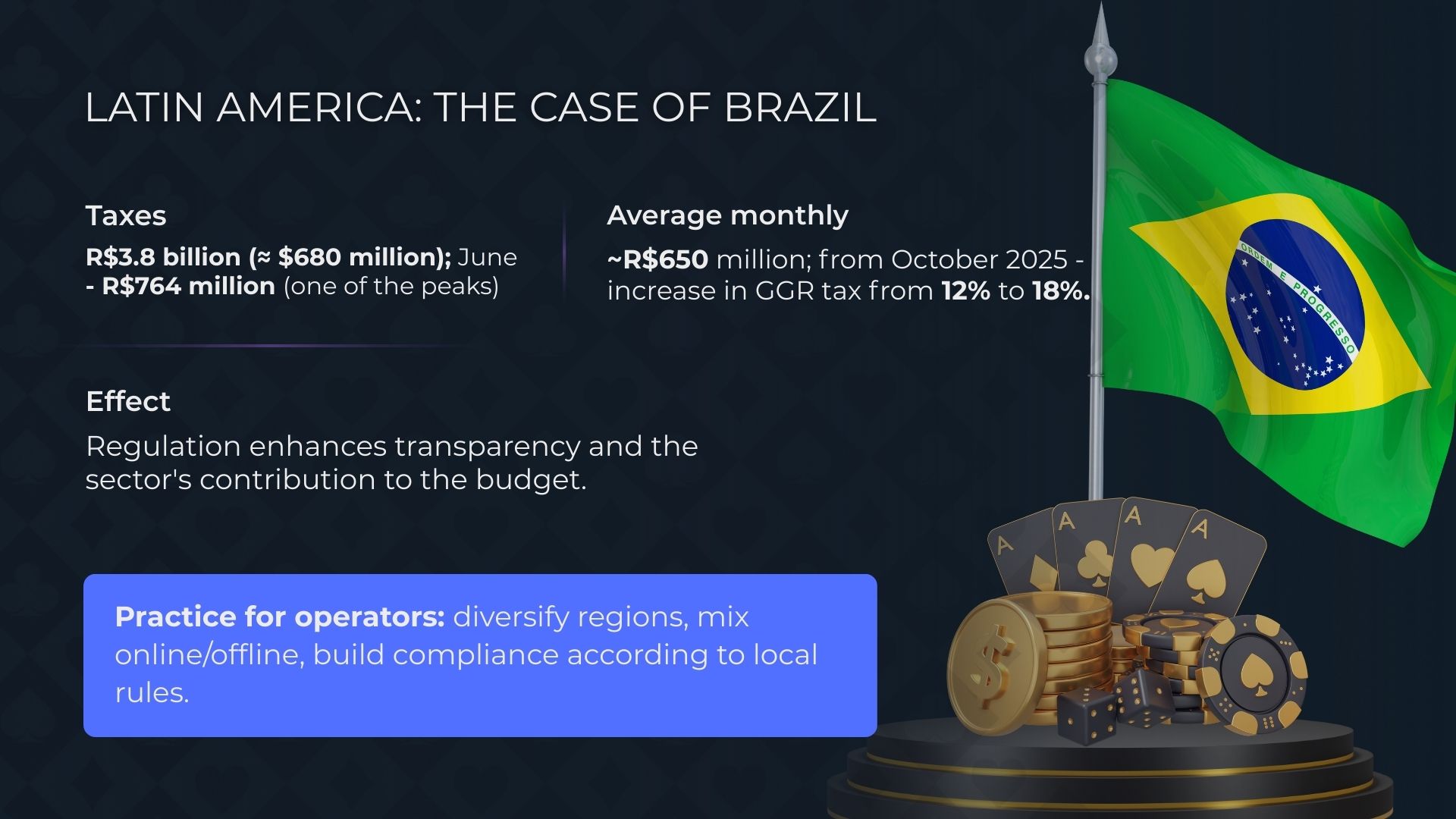

Brazil: Record revenues and gambling tax contributions

In H1 2025, Brazil’s regulated gambling market delivered impressive results. Total tax revenues reached BRL 3.8 billion (about USD 680 million), significantly exceeding last year’s figures.

June 2025 stood out, with tax revenues of BRL 764 million, one of the highest levels since legalization.

Average monthly revenue in H1 reached BRL 650 million, reflecting stable and sustainable sector growth.

Forecasts for H2 2025 anticipate further increases in tax revenues, particularly with the rise in the gross gaming revenue (GGR) tax rate from 12% to 18%, effective October 2025.

These results confirm the success of Brazil’s legalization and regulation strategy and highlight the gambling industry’s significant contribution to the national economy.

Conclusion and outlook: global gambling revenue trends

The first half of 2025 showed that the global gambling industry continues to grow steadily, but revenue sources vary by region. In the US, sports betting hit a record $2.035 billion, up 42.6% y/y, while casinos earned $65 million, driven by slots and declining table games. The main growth factor here remains digital casino software and mobile applications, while premium land-based segments remain stable.

In Europe, trends are uneven. Lithuania and OPAP show rapid online growth — up 18–22% in six months — while Sweden grew just 1.9% due to tighter regulations and land-based casino closures. Online casino platforms and lotteries are the main growth drivers, while traditional offline casinos gradually lose significance.

Macau regained land-based leadership: revenues reached $2.76 billion, with high hotel occupancy and tourism activity boosting profitability. Slots and VIP table games remain the primary sources of revenue, while the integration of entertainment, hospitality, and gambling creates a sustainable model for casino software providers.

Brazil, having recently launched a fully regulated market, generated $2.3 billion in gross revenues from 17.7 million active players across 182 licensed platforms in H1 2025. Strong regulation and the fight against illegal operators foster a safe and transparent environment, ensuring the long-term potential of white label online casino and turnkey online casino solutions.

Thus, the global gambling market in 2025 is shaped by three key drivers: digitalization and online casino software platforms, the expansion of sports betting, and regulatory stability supported by leading igaming software providers.