The debate over the future of online gambling in France is reaching a new level. Amid rising illegal activity and growing pressure from industry associations, the government is considering potential regulatory changes; however, the largest representatives of the land-based segment strongly oppose the legalization of online casinos.

The debate over the future of online gambling in France is reaching a new level. Amid rising illegal activity and growing pressure from industry associations, the government is considering potential regulatory changes; however, the largest representatives of the land-based segment strongly oppose the legalization of online casinos.

Escalating Conflict Between Offline and Online Lobby Groups

Casinos de France, representing the interests of most land-based casinos in the country, stated that opening the market would lead to significant losses for the state budget and negatively impact regional economies. According to the association’s estimates, the emergence of legal online casinos could reduce government revenues by more than half a billion euros annually, considering indirect costs related to healthcare and social burdens.

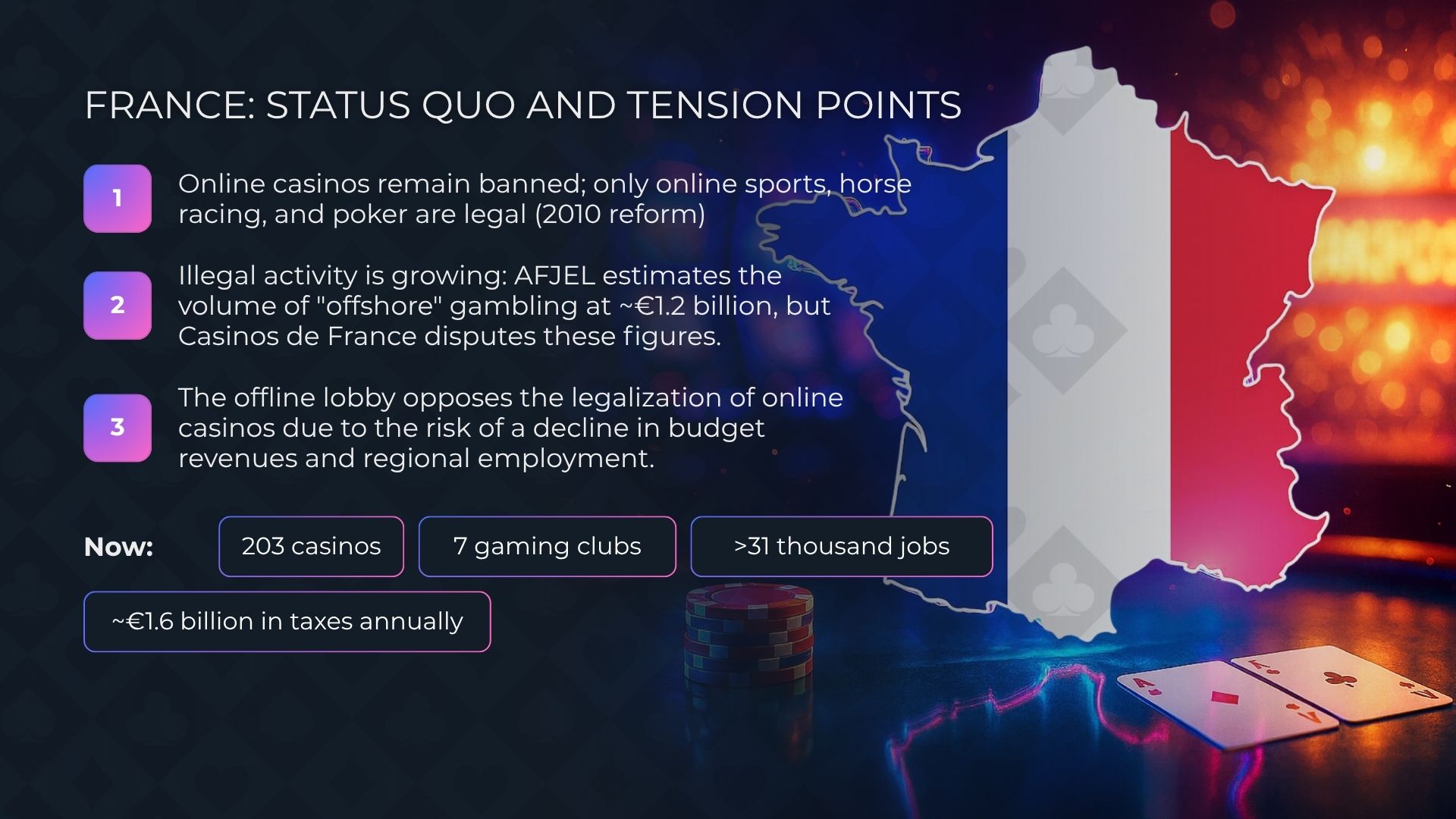

The association also argues that concerns about the “shadow market” are exaggerated. Their position directly contradicts AFJEL’s assessments, which represents online operators and claims that the volume of illegal bets reaches €1.2 billion. Casinos de France rejects these figures as “misleading,” emphasizing that the real threat lies not in the potential revenue but in the socio-economic consequences.

Today, France hosts 203 casinos and seven gaming clubs, employing more than 31,000 people. The sector generates approximately €1.6 billion in tax revenues annually, including substantial contributions to municipal budgets. Representatives of the land-based segment are convinced that opening the online market would inevitably reduce these financial flows.

Learn more about the gambling market in 2025: how to choose a segment and launch a successful online casino

Regulatory Context: The State Between Pressure and Caution

The French iGaming market has followed a conservative model for more than a decade. After the 2010 reform, the state permitted only limited types of online betting — sports wagering, horse racing, and poker. Since then, ANJ, the national gambling regulator, has consistently reported an increase in illegal platforms despite stricter enforcement.

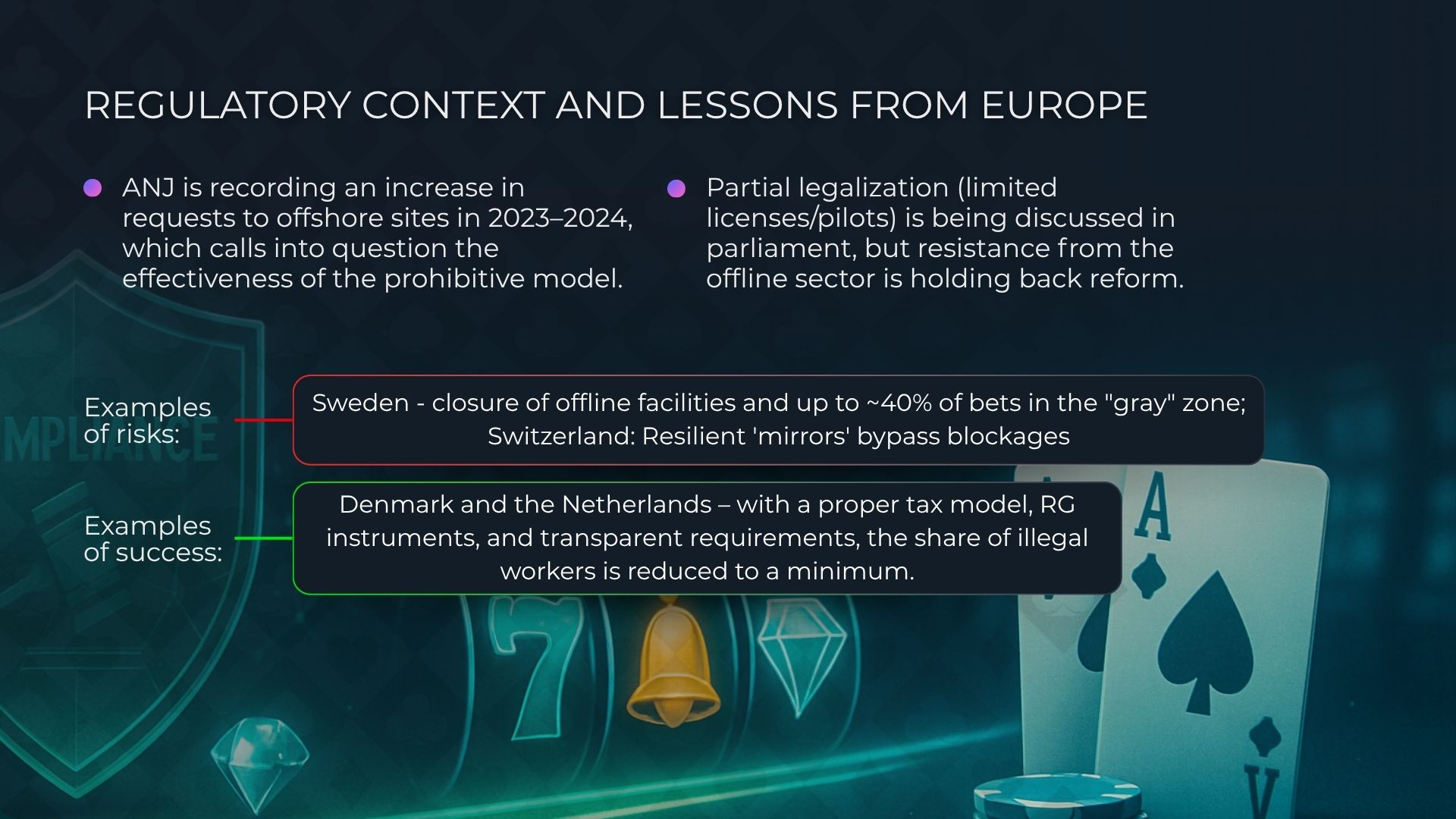

According to ANJ’s data for 2023–2024, the share of players turning to offshore websites continues to grow, calling into question the effectiveness of the restrictive model. Parliament is currently discussing options for partial legalization, including limited licenses or pilot projects. However, due to the firm opposition of land-based operators, the advancement of these initiatives remains difficult.

European Experience: Lessons from Neighboring Markets

Opponents of reform actively cite examples of countries where opening the online market resulted in challenges. In Sweden, following liberalization, several major land-based casinos were shut down, and the share of illegal betting, according to the regulator, remains close to 40%. In Switzerland, the primary issue has been mirror websites that systematically bypass blocking measures.

However, there is an opposite trend elsewhere in Europe. Denmark and the Netherlands demonstrate that with a properly structured tax system, mandatory responsible gaming tools, and transparent operator requirements, the share of the illegal market can be reduced to minimal levels. These models are viewed by many experts as benchmarks capable of balancing player protection with economic benefits.

More on the topic: Online gambling in Europe: the share of illegal operators reached a record 71%

What France Can Expect

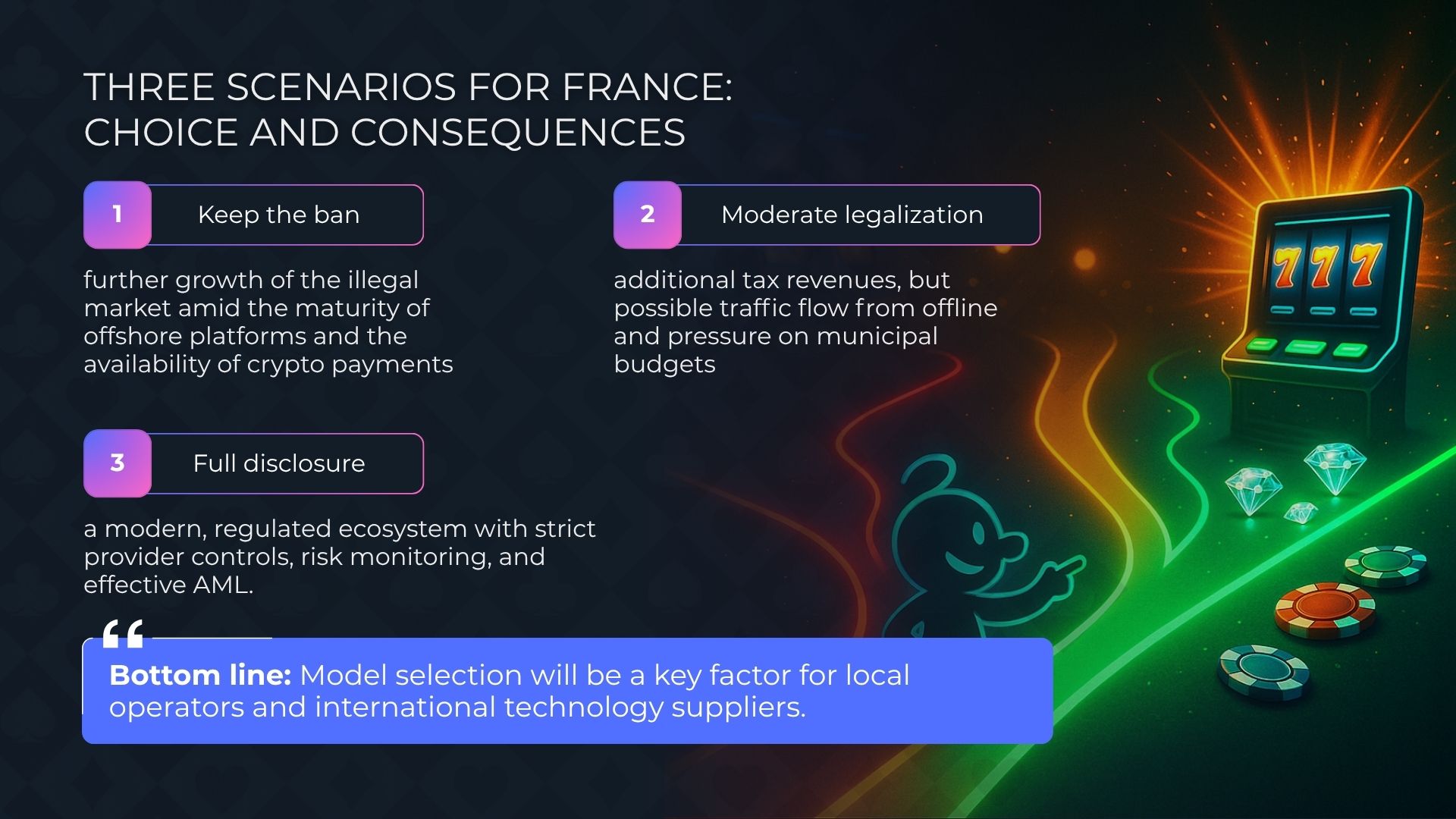

If the government maintains the current ban, the illegal operator market will continue to grow, according to analysts, given the technological maturity of offshore platforms and the availability of crypto payments. Under a scenario of partial legalization, the state may receive additional tax revenues, although the potential redistribution of traffic from land-based to online casinos could create risks for regional budgets and traditional venues.

In the case of full market liberalization, industry experts believe France could build a modern, regulated iGaming ecosystem. However, this would require strict oversight of providers, advanced risk-monitoring technologies, and an effective anti-money-laundering compliance framework — especially for any casino platform, online casino software, or turnkey online casino solutions entering the market.

Conclusion: A Defining Choice for the Market’s Future

France is among the last major European markets where online casinos remain fully prohibited. The ongoing debate between land-based operators and representatives of the digital segment reflects a fundamental question: should the state adhere to the traditional model or move toward a regulated omnichannel system capable of reducing the share of illegal gambling?

The path France ultimately chooses will be decisive not only for local operators but also for international technology companies — including any igaming software provider, casino software providers, or white label online casino vendors — who may become key partners in building a safe and sustainable online gambling ecosystem.