The European online gambling market is facing a structural imbalance: illegal platforms have surpassed licensed operators in terms of volume and taken a dominant position. According to a Yield Sec study conducted for the European Casino Association, in 2024 the shadow sector accounted for more than €80 billion, representing 71% of the total iGaming market. By comparison, licensed companies collectively earned only €33.6 billion.

This trend highlights not only the scale of the problem but also systemic flaws in regulation. Unlike licensed operators, constrained by strict rules, unlicensed websites freely use cryptocurrency transactions, anonymous payment systems, and aggressive marketing practices. The result is an uneven competitive landscape where licensed companies lose market share and governments lose tax revenues.

By the end of 2024, the total size of the European online gambling market reached €114.3 billion. However, revenue distribution proved extremely uneven:

-

€80.6 billion (71%) went to illegal websites operating without national licenses;

-

only €33.6 billion (29%) was generated by officially licensed companies.

The study shows that the illegal segment is not only maintaining its position but actively growing. Its share increases because unlicensed platforms offer players fewer restrictions, new gaming formats, and a wide range of payment solutions, including cryptocurrency.

The situation across individual countries confirms the scale of the problem:

-

Germany: the national regulator GGL identified more than 850 active illegal websites, accounting for up to a quarter of the entire online gambling market. Despite attempts to block sites and restrict advertising, the grey sector remains resilient.

-

Sweden: the channelization rate, i.e. the share of players using licensed operators, fluctuates between 69–82% against a target of 90%. Reports also record nearly a tenfold increase in traffic to illegal sites compared to previous years.

-

Italy: bets placed on illegal platforms are estimated at up to €25 billion annually, representing as much as 75% of the entire market—one of the highest levels in the EU.

The situation is further complicated by the fact that in countries with the strictest regulations (Italy, France, Sweden), the share of illegal operators is higher than average. This points to a paradox: tougher restrictions do not reduce the shadow market but instead push players toward alternative platforms.

See also: Where and how to get an online casino license in Europe?

Why Players Choose Illegal Platforms

The main reason for the growth of illegal operators lies in the imbalance between demand and the regulatory environment. While licensed companies are obliged to comply with strict betting limits, advertising restrictions, and customer identification requirements, illegal websites operate with virtually no constraints, making them more appealing to certain players.

Additional factors include:

-

Excessive regulation. In countries with strict rules (Italy, France, Sweden), some of the highest shares of the illegal sector are recorded. Players migrate to platforms without deposit or loss limits.

-

Growth of crypto casinos. Platforms operating with digital currencies ensure anonymity and bypass national payment restrictions. According to the Financial Times, in 2024 the turnover of crypto operators exceeded $80 billion.

-

Marketing pressure. Illegal websites rely on aggressive promotion through social media, messaging apps, and influencers, unrestricted by advertising bans.

-

Technological flexibility. Operators frequently change domains, use VPN services, and in some cases even exploit official identification systems (e.g., BankID in Sweden), creating the illusion of legitimacy.

Thus, illegal platforms offer a product that appears more “convenient” to players than regulated companies. However, this perceived attractiveness comes at the cost of lacking payout guarantees and personal data protection, turning the issue from an economic into a social problem.

See also: Responsible gambling in Europe: how the rules are changing

Economic and Social Risks of Illegal Market Dominance

The dominance of illegal operators has a multi-layered impact on the European iGaming market:

-

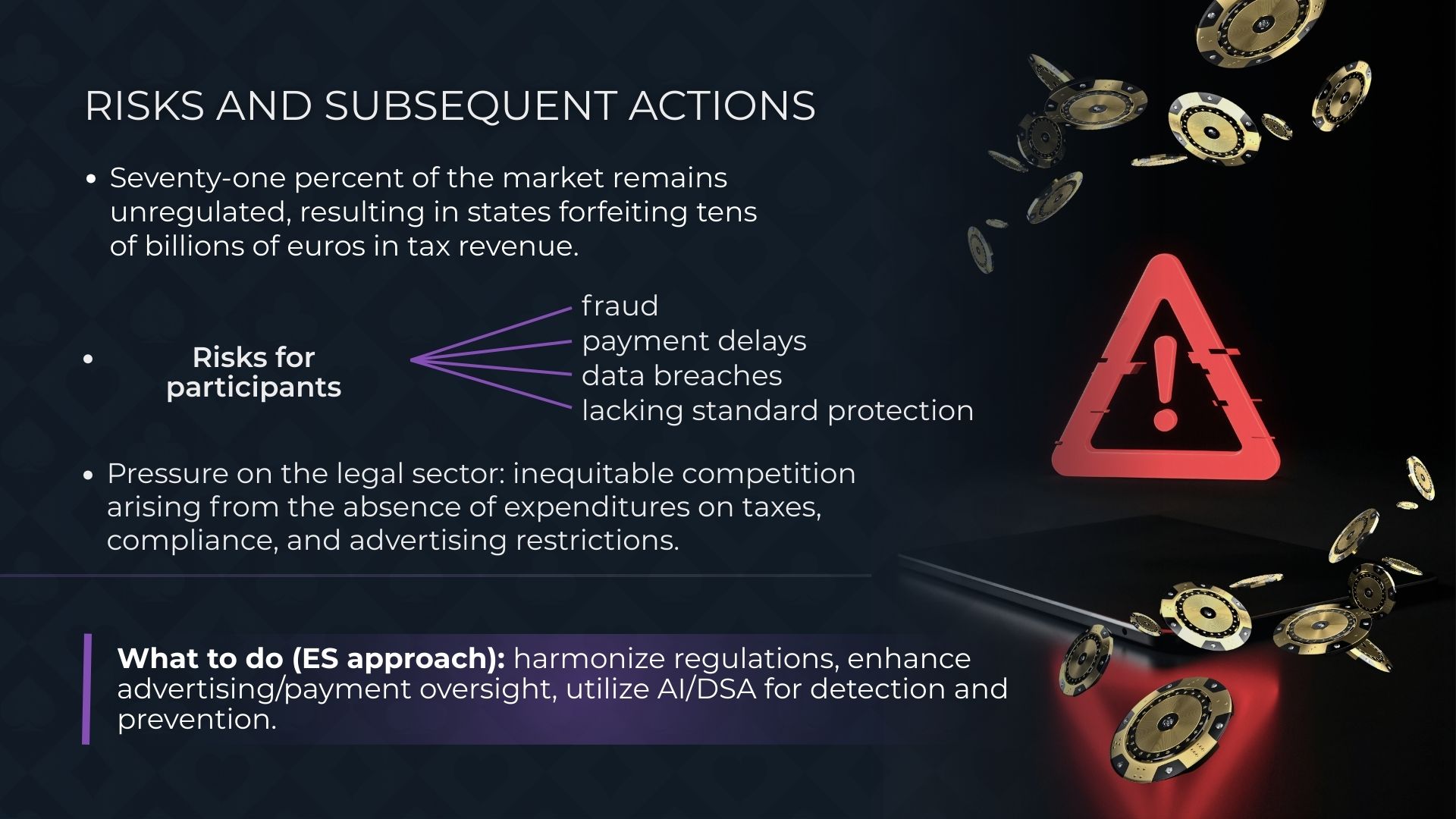

Economic losses. Governments lose tax revenues estimated at tens of billions of euros annually. Considering that illegal platforms control 71% of the market, these losses are systemic and limit the ability to fund public programs.

-

Player risks. Lack of regulatory oversight leads to frequent cases of fraud, payment delays, and personal data breaches. Players are deprived of the standard protections offered by licensed companies.

-

Pressure on the legal sector. Licensed operators lose market share and are forced to compete with platforms that do not bear the costs of taxation, compliance, and marketing restrictions.

Together, these factors create a systemic threat to the entire industry. The problem requires coordinated action at the EU level: harmonizing regulations, strengthening control over advertising, and deploying new technologies (AI, Digital Services Act) to identify and block illegal platforms.

The conclusion is clear: without joint measures, the share of the illegal market will remain high, leaving licensed operators in a vulnerable position. Sustainable development of European iGaming requires a balance between strict regulation and supporting the legal sector.