Online gambling has experienced exponential growth in recent years. Just ten years ago, online casinos were perceived as a niche segment of the entertainment industry, but by 2025, they have become a full-fledged market with billion-dollar turnovers and global competition.

Online gambling has experienced exponential growth in recent years. Just ten years ago, online casinos were perceived as a niche segment of the entertainment industry, but by 2025, they have become a full-fledged market with billion-dollar turnovers and global competition.

Interest in the question “how much do online casinos earn” today is driven not only by players’ curiosity but also by the strategic interests of investors, tech companies, and entrepreneurs considering iGaming as a business opportunity. As more countries introduce licensing and regulatory oversight, and as major corporations expand into new markets, online casino profitability becomes a key indicator of the sector’s overall attractiveness.

In this study, we will examine:

-

how much the largest online casino operators earn;

-

the average revenue figures for a “baseline” casino;

-

which regions and business models are driving the most growth in 2025.

Global Online Casino Market in 2025

The global online casino market in 2025 is estimated at $38–40 billion. This represents only a portion of the overall online gambling industry, which exceeds $100 billion when including sports betting, poker, and lotteries. Although sports betting often attracts more media attention, casino games form the stable revenue base: users play slots, roulette, and live games, not just bet on events.

According to Statista, in 2025 the average revenue per user (ARPU) is approximately $327 per year. Considering that the global share of online casino users approaches 3.2% of the population, the scale becomes evident: tens of millions of people worldwide regularly play online, providing operators with stable cash flow.

Market growth is driven by several factors:

-

Legalization and Regulation. New jurisdictions, such as the USA and Latin America, provide access to millions of users.

-

Technology. Mobile apps and live games boost player engagement and increase average spend per session.

-

Changing Consumer Habits. Online gaming is becoming a standard part of digital entertainment, competing with streaming video and social media for users’ attention.

Thus, by 2025, online casinos have evolved into a sustainable and scalable business model with predictable cash flow and growth opportunities even in mature markets.

Read more: How to Launch an Online Casino in 4 Steps: 2025 Guide

Regional Revenue Differences

Europe: Mature and Regulated Market

Europe has traditionally remained the largest online casino market. According to the European Gaming and Betting Association (EGBA), in 2024 casino game revenue reached €21.5 billion, making this segment a key source of income for regional operators. Europe’s distinctive feature is its high level of regulation: nearly all major EU countries have implemented their own licensing regimes. This limits aggressive growth through strict marketing and bonus rules, but provides predictability and long-term stability for operators.

USA: Driver of Global Growth

The American market has become the main source of exponential growth. While gross online casino revenue in 2024 was $8.4 billion, projections for 2025 estimate growth to $12.7 billion. Each newly legalized state immediately brings millions of new users. Major players—FanDuel, DraftKings, and BetMGM—split the market nearly evenly, creating intense competition and driving high marketing expenditures.

Asia and Latin America: Prospects for the Future

The Asia-Pacific (APAC) region and Latin America remain undervalued, yet analysts see the greatest potential here. In 2024, the online gambling market in Asia was estimated at $19 billion, with many countries still developing their legal frameworks. Latin America (Brazil, Colombia, Argentina) is opening markets to licensed operators, and rapid internet penetration makes the region one of the most promising over the next five years.

Read more: Where to Launch a Casino in 2025: Top High-Potential GEOs

Regional Revenue Differences

|

Region |

Online Casino Revenue (2024) |

2025 Forecast |

Market Features |

|---|---|---|---|

|

Europe |

€21.5 billion |

Moderate growth (3–5% per year) |

High regulation, limited bonuses, stable profitability |

|

USA |

$8.4 billion |

~$12.7 billion (+24%) |

Rapid state openings, high competition, leaders: FanDuel/DraftKings/BetMGM |

|

Asia (APAC) |

~$19 billion (total online gambling) |

Double-digit growth |

Low regulation, significant grey market segment |

|

Latin America |

No unified estimate (market developing) |

Rapid growth in Brazil, Colombia, Argentina |

Licensing just starting, high mobile user engagement |

Largest Online Casinos and Their Revenue

The online gambling market in 2025 is largely driven by several international giants that set the industry’s pace.

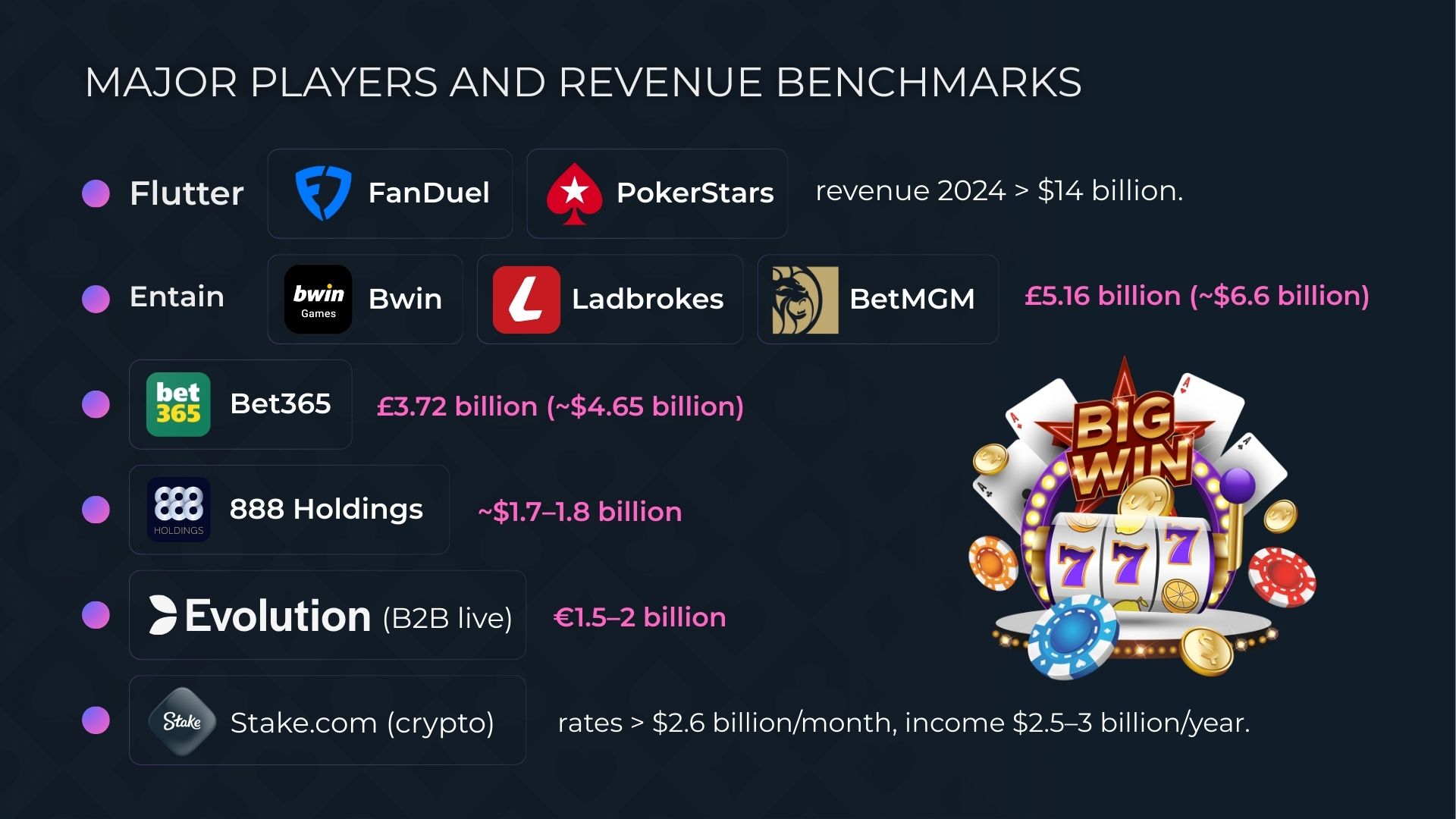

Flutter Entertainment holds a leading position: in 2024, its revenue exceeded $14 billion (+19% YoY). The main driver is its American brand FanDuel, which has become the absolute number one in the US. Its portfolio is complemented by PokerStars and Paddy Power, making Flutter the most diversified market player.

Entain plc, owner of Ladbrokes, Bwin, and PartyCasino, also strengthened its position with revenue of £5.16 billion (~$6.6 billion). Its key advantage is the partnership with MGM Resorts through BetMGM, the second-largest operator in the US.

Private company Bet365 remains one of the most profitable players, generating £3.72 billion (~$4.65 billion). Despite a conservative public presence, Bet365 maintains strong positions in the UK, Europe, and Asia.

Smaller but still notable in scale is 888 Holdings, with 2024 revenue around $1.7–1.8 billion. After acquiring William Hill, the company strengthened its presence in key European markets, focusing on casino and poker.

Finally, Evolution illustrates that not only operators but also B2B providers can achieve billion-dollar status. With revenue of €1.5–2 billion, the company dominates the live game segment, effectively setting trends in this niche.

Particular attention should be paid to Stake.com—a crypto online casino and sportsbook that grew rapidly through a focus on digital marketing and streaming. According to the Financial Times, Stake processed bets totaling over $2.6 billion per month in 2023, with annual revenue estimated at $2.5–3 billion. This makes Stake the largest crypto platform in iGaming and a symbol of a new wave of operators prioritizing anonymity, instant transactions, and a global audience.

Read more: Top 10 Casino Software Providers in 2025

How Much Can a Baseline Online Casino Earn?

While giant operators generate billions, the situation for an average online casino is different. Several factors determine potential revenue: active user base, geography, profit margins, bonus policies, and software selection.

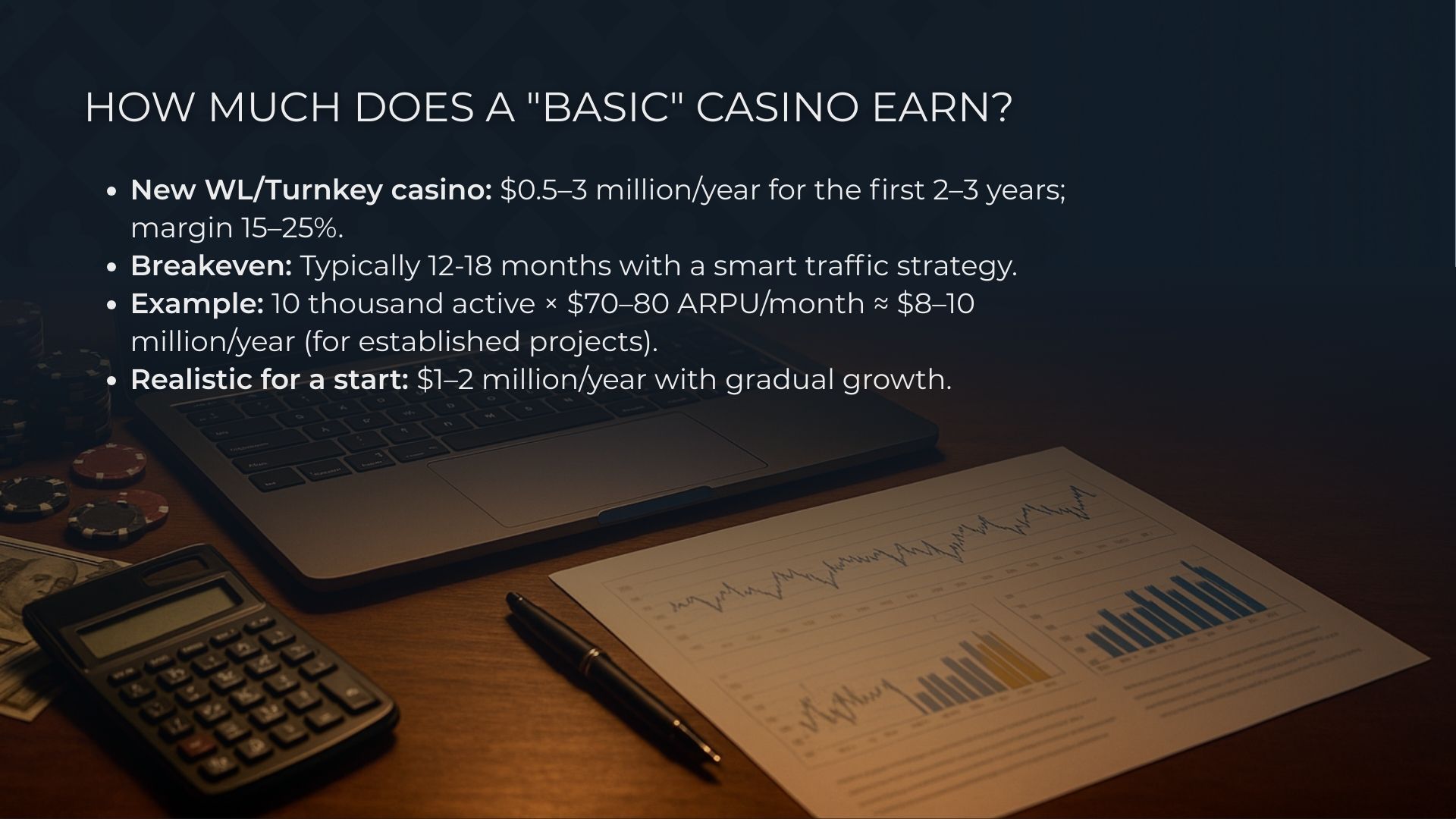

According to industry analysts, a typical new casino operating under a white-label or turnkey model can expect the following:

-

Revenue: $500K–$3M per year in the first 2–3 years.

-

Profit Margin: typically 15–25%, depending on marketing spend.

-

Break-even Point: usually achieved within 12–18 months with a proper traffic acquisition strategy.

-

Key Growth Driver: player retention—acquiring 10,000 users is one thing, but ensuring 30–40% return monthly is another.

Example: a casino with 10,000 active players and ARPU of $70–80 per month can generate around $8–10 million in annual revenue. Such results are usually attainable for projects that have already established themselves and manage traffic effectively.

For a smaller “baseline” casino entering the market, more realistic figures are $1–2 million per year, with gradual growth.

|

Development Stage |

Annual Revenue |

Profitability |

Active Players |

Key Features |

|---|---|---|---|---|

|

Startup Casino (6–12 months) |

$300K–$800K |

5–10% |

up to 5,000 |

Primary focus is on acquiring the initial user base, with high marketing expenditure. |

|

Stable Casino (1–3 years) |

$1–3M |

15–20% |

5–15K |

Break-even achieved, establishing a regular player base. |

|

Growing Casino (3+ years) |

$5–10M |

20–25% |

20–50K |

Market consolidation, competing with regional brands. |

Factors Affecting Online Casino Profitability

Casino profitability in 2025 depends not only on invested capital but also on dozens of variables. Key factors include:

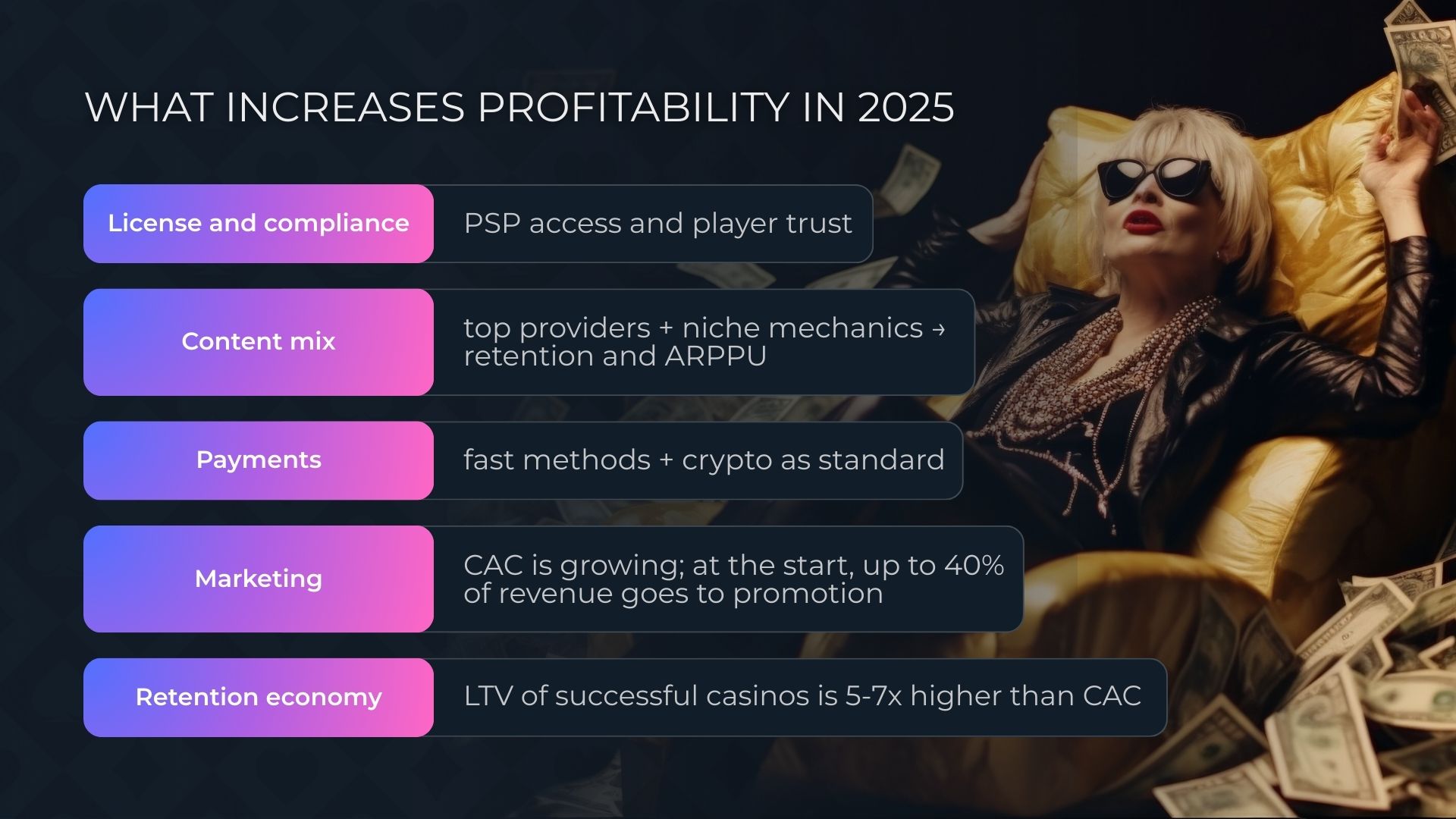

Regulation and Licensing

- Casinos licensed in Malta (MGA) or the UK gain access to payment systems and higher player trust, but compliance costs are higher.

- Grey jurisdictions are cheaper but limit scaling opportunities and may deter some users.

Game Content Selection

- Slots from top providers (Pragmatic Play, Evolution, NetEnt) attract a broad audience.

- Niche games or exclusive content help retain dedicated players.

Marketing and Player Acquisition

- In 2025, customer acquisition costs (CAC) have risen: Google and Meta advertising are limited, so streamers and influencers have become key channels.

- Successful projects invest up to 40% of revenue in marketing during the launch phase.

Payment Solutions

- Support for cryptocurrencies and fast transactions has become standard.

- Casinos without convenient deposit/withdrawal options lose a significant portion of their audience.

Retention and Player Economics

- Players rarely return solely for bonuses. Retention relies on a mix of smart bonus policies, game volatility, and personalized offers.

- Lifetime value (LTV) in successful casinos is 5–7 times higher than CAC.

Read more: Trends Every Aspiring Online Casino Operator Should Know

Conclusion: How Much Do Online Casinos Earn in 2025?

In 2025, online casinos remain one of the most profitable iGaming sectors, but revenue levels vary significantly.

Largest operators (Entain, Flutter, Bet365, Stake) generate billions in revenue, operating under global market rules and investing hundreds of millions in marketing, technology, and licensing.

New startups with the right strategy can reach $1–2 million annually by the second year, provided they have sufficient funding and an appropriate jurisdiction.

Online casinos are not about quick profits but about building a systematic business in a highly competitive environment. Success goes to those who establish long-term player relationships rather than chasing instant registrations.

Considering rising traffic costs and increasing regulatory complexity in 2025, winning projects are those that offer a diversified game portfolio, leverage innovative marketing channels (streamers, social platforms, Telegram communities), and prioritize financial transparency and convenient payments.

Such casinos are the ones most likely not only to survive but also to secure a position among market leaders.