The gambling market is undergoing rapid transformation, driven by digitalization, increasingly complex regulations, and intensifying competition. For entrepreneurs, investors, or operators planning to launch or expand an online casino, a fundamental understanding of iGaming market structures is no longer optional — it is strategically essential.

The gambling market is undergoing rapid transformation, driven by digitalization, increasingly complex regulations, and intensifying competition. For entrepreneurs, investors, or operators planning to launch or expand an online casino, a fundamental understanding of iGaming market structures is no longer optional — it is strategically essential.

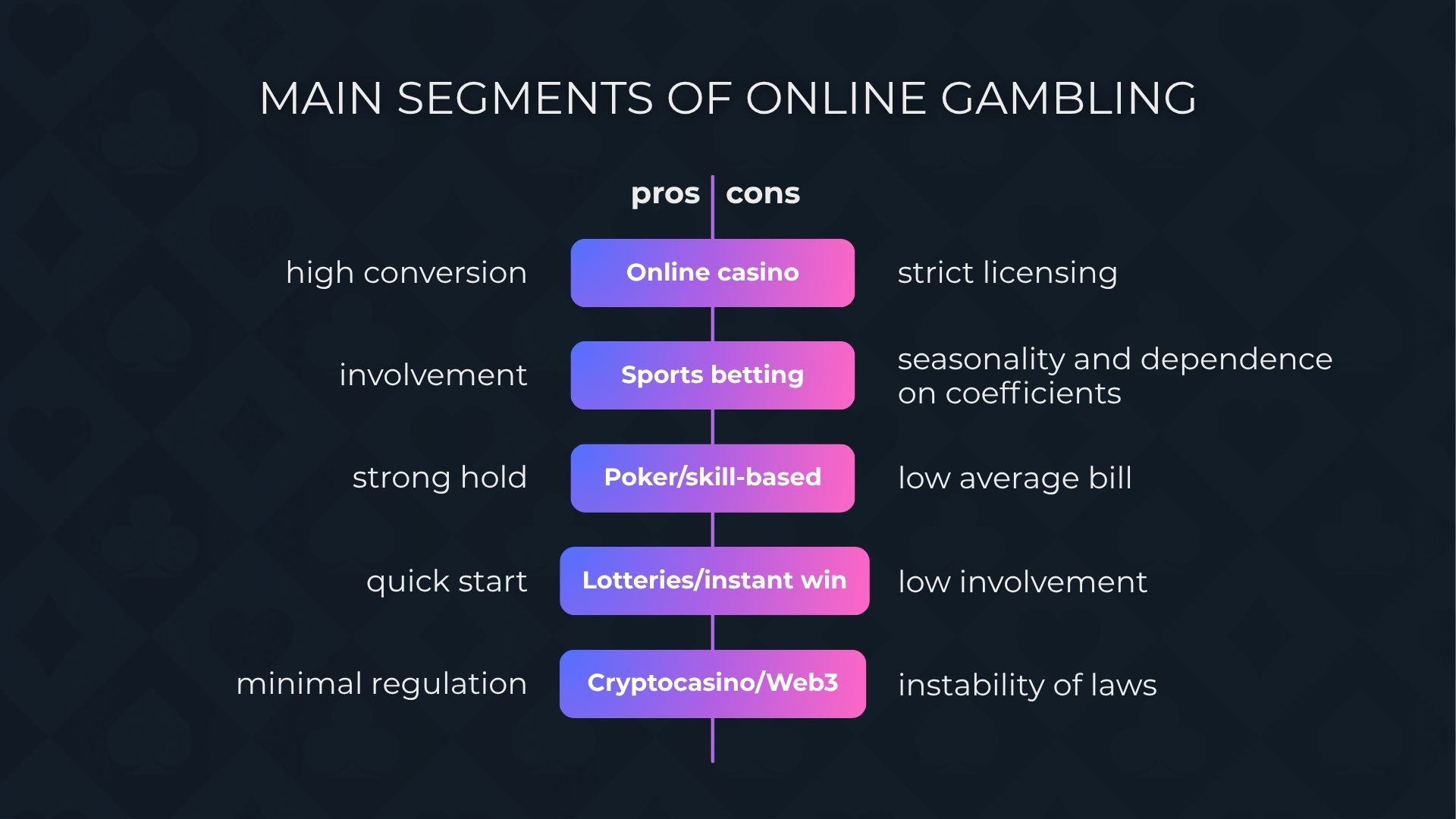

Today, gambling is not a single market but a collection of diverse verticals: from sports betting and slots to crypto casinos and social gaming. Each segment has its own specifics: target audience, legal restrictions, financial entry barriers, competitive maturity, and potential profitability. Choosing a segment directly affects the business model, monetization strategy, and time to break even.

It is also crucial to consider geography: the degree of legalization, player preferences, and licensing requirements vary significantly by region. Markets that seemed promising five years ago may now be oversaturated or heavily regulated. Conversely, new niches are emerging that require minimal investment but offer substantial growth potential.

In this article, we will systematically examine the main segments of the iGaming industry, market types, key trends, and factors to consider when choosing a direction for launching or scaling a project.

The Global Gambling Market in 2025: Structure and Prospects

In 2025, the global gambling market continues to grow steadily despite stricter regulations and intensifying competition. The total industry volume is estimated in the hundreds of billions of dollars, with the online segment increasing its share due to mobile devices, digital payment systems, and changing consumer behavior.

The market is traditionally divided into two main categories: land-based gambling and online gambling (iGaming). While the offline sector remains significant in certain regions (USA, Asia, Latin America), the online segment is showing the highest growth rates.

| Region | Market Characteristics | Opportunities for Operators | Regulatory Features |

|---|---|---|---|

| Europe | Mature market with high competition and transparent rules | Suitable for operators with long-term strategies and strong compliance standards | Strict regulation, mandatory licenses, strong focus on Responsible Gambling |

| North America | Fast-growing market, especially in the U.S. due to legalization of online betting | High margins in certain states; attractive for large investors | State-level licensing, no unified jurisdiction; requires local presence |

| Asia | Fragmented market with high user engagement | Strong demand, especially for mobile gambling and sports betting | Many countries ban gambling; projects operate via offshore licenses and “grey” schemes |

| Latin America | Developing market with a large population and growing interest in iGaming | Suitable for new brands and operators with strong local adaptation | In transition to legalization: Brazil, Colombia, and Peru are introducing national regulators |

| Africa | Mobile-first market with low competition and growing betting interest | Good entry point for budget-friendly projects | Weak or absent regulation; high instability risks |

| Middle East | Complex and conservative market but with high spending potential | Attractive for offshore B2C and VIP-focused projects | Gambling is officially banned; only indirect operations are possible |

The global gambling market structure includes dozens of segments — from classic casinos and betting to social and hybrid models. In 2025, projects with strong local adaptation, flexible monetization, and technology infrastructure capable of meeting diverse jurisdictional requirements will be especially relevant.

For entrepreneurs, this means the need to not only choose the right vertical but also realistically assess the potential of a specific market in terms of regulation, audience, and competition.

Read more: How to Choose a GEO for Launching a Gambling Project

Types of Online Gambling: Comparative Analysis of Segments for Business Launch

Online gambling develops unevenly — some verticals deliver stable monetization but require substantial investment, while others allow for quick hypothesis testing with minimal costs. When choosing a direction, it is important to assess not only potential profitability but also technological, legal, and operational constraints.

| Vertical | Brief Description and Features | Business Prospects and Risks |

|---|---|---|

|

Online Casino |

The most mature segment. Includes slots, live dealers, and table games. Requires a license, a powerful platform, content providers, and PSP integration. |

Advantages: wide range of ready-made software, high conversion and retention rates. |

|

Sports Betting |

Focused on real-world events. High user engagement. Requires odds calculation algorithms and trading teams. |

Advantages: frequent deposits, strong engagement, opportunities for localization based on player interests. |

|

Poker / Skill-Based |

Games involving skill elements. Lower monetization per user but strong retention. Built around a community. |

Long-term loyalty but low average check and high player retention complexity. Best suited for ecosystem-driven projects. |

|

Lotteries / Instant Win |

Simple mechanics, minimal development requirements. Instant wins, mass reach. Ideal for emerging markets. |

Fast launch and low costs but weak engagement and limited monetization. Works well as an additional product. |

|

Crypto Casinos / Web3 |

Minimal regulation, fast implementation. Technological novelty, crypto-based payments. Appeals to niche but highly active audiences. |

High growth rate, especially in certain regions. However, legislative instability and limited traffic access are significant challenges. |

Market Types: Regulated, Grey, and Illegal Zones

In the online gambling sector, there are three main types of markets — regulated, grey, and illegal. Each has its own legal status, specific characteristics, and risk levels for operators.

Regulated Gambling Markets

These are jurisdictions where online casinos and betting are legally permitted, and operator activities are strictly supervised by government authorities.

Legal status: operation is only possible with a local license, compliance with technical requirements, and financial standards.

-

High level of player trust

-

Access to local payment systems

-

Reduced legal risks

-

High cost and lengthy process of obtaining a license

-

Strict KYC/AML and data protection requirements

Grey Market for Online Casinos

Countries where online gambling lacks a clear legal framework: it is not directly prohibited, but it is also not regulated.

Legal status: operators can work under offshore licenses (Curacao, MGA, Kahnawake) without full local oversight.

-

Fast market entry without local registration

-

Low entry barriers

-

Ability to test products and marketing strategies

-

Potential for future bans

-

Limited access to local payment channels

Illegal Zones

Countries where online gambling is explicitly prohibited by law.

Legal status: any casino or bookmaker activity is a criminal offense with severe consequences.

-

Opportunities are virtually non-existent — the risk is too high

-

Likely website and payment channel blocking

-

Criminal liability for operators and partners

-

Reputational damage

Overall, choosing between regulated, grey, and illegal markets in iGaming depends on balancing potential profit against acceptable risk levels. Regulated markets provide high legal protection and business stability but require significant licensing costs and compliance efforts. Grey zones offer more flexibility and lower entry thresholds but involve legal uncertainty and possible restrictions. Illegal markets may generate quick profits but come with maximum legal and reputational risks, making their long-term sustainability questionable.

How to Choose a Market and Segment for Launching an Online Casino

Choosing a market and niche is a strategic decision that determines the long-term success of your iGaming project and the selection of a reliable gambling software provider. A mistake at this stage can lead to difficulties in attracting players, legal risks, and unjustified expenses.

Demand and Competitive Landscape Analysis

Before selecting a market for an online casino, it is necessary to evaluate:

-

The size and dynamics of the target audience;

-

The popularity of key gaming verticals (slots, live casino, sports betting, poker);

-

Market saturation and presence of major operators;

-

Local preferences for payment methods and currencies.

Defining the Business Model

At launch, it is important to choose a model that matches the budget, timelines and objectives:

-

White Label online casino — rapid launch under an existing license and infrastructure. Suitable for market testing and risk minimization.

-

Custom platform — bespoke development of an online casino platform offering maximum flexibility and control over the project.

-

Turnkey solution — a platform integrating multiple content providers. Accelerates go-to-market and broadens the offering, but requires development of a distinct positioning.

Choosing a Jurisdiction and Payment Infrastructure

Jurisdiction determines not only the legality of operations, but also marketing opportunities, player trust and cooperation conditions with game providers. When selecting one, consider:

-

Regulatory requirements and the cost of obtaining a license;

-

Taxation;

-

The jurisdiction’s reputation among players and partners;

-

Availability of popular payment methods and support for cryptocurrencies.

Conclusion: A successful iGaming launch starts with a thorough selection of market and segment. The optimal combination of niche, business model, jurisdiction, and online casino platform solutions will enable rapid access to the target audience and ensure sustainable growth.

Strategy for Success in the Gambling Market — Not Luck, but Calculation

In the iGaming industry, those who act systematically win. Choosing a jurisdiction, model and target market is only the first step. The key to sustainable growth lies in a well-thought-out business strategy that takes into account:

-

Long-term planning — a clear understanding of where the project should be in 1, 3 and 5 years.

-

Diversification — distributing assets across different markets, verticals and products to reduce dependence on a single revenue source.

-

Flexibility — readiness to adapt to changes in legislation, technology and player behaviour.

For entrepreneurs and investors in gambling, launch speed is less important than the solidity of the foundation. A strong strategy and risk control enable not only market entry, but also long-term market consolidation.