The global online gambling market has entered a maturity phase: in key European jurisdictions saturation is evident, regulatory pressure is intensifying, and player acquisition costs have reached historical highs. This requires operators not merely to scale up, but to conduct pinpointed geo-intelligence—seeking undervalued yet promising markets with an optimal balance of risk and potential return.

The global online gambling market has entered a maturity phase: in key European jurisdictions saturation is evident, regulatory pressure is intensifying, and player acquisition costs have reached historical highs. This requires operators not merely to scale up, but to conduct pinpointed geo-intelligence—seeking undervalued yet promising markets with an optimal balance of risk and potential return.

The 2025–2026 period opens unique opportunities: dozens of countries are updating their online gambling regulations; major regions (e.g., Latin America, Southeast Asia, and Africa) are experiencing explosive growth in mobile internet and digital payments; and cryptocurrency- and Web3-based models lower the entry barrier even in the most compliance-challenging zones.

In this article, we examine ten regions—each offering unique conditions for launching an online casino or betting project in 2025–2026. All recommendations are based on current market data, legal initiatives, and the experience of leading operators and platforms.

Market assessment methodology: how to determine the potential?

- Audience size and growth: population, internet and smartphone penetration

- Payment infrastructure: availability of popular PSPs and crypto solutions

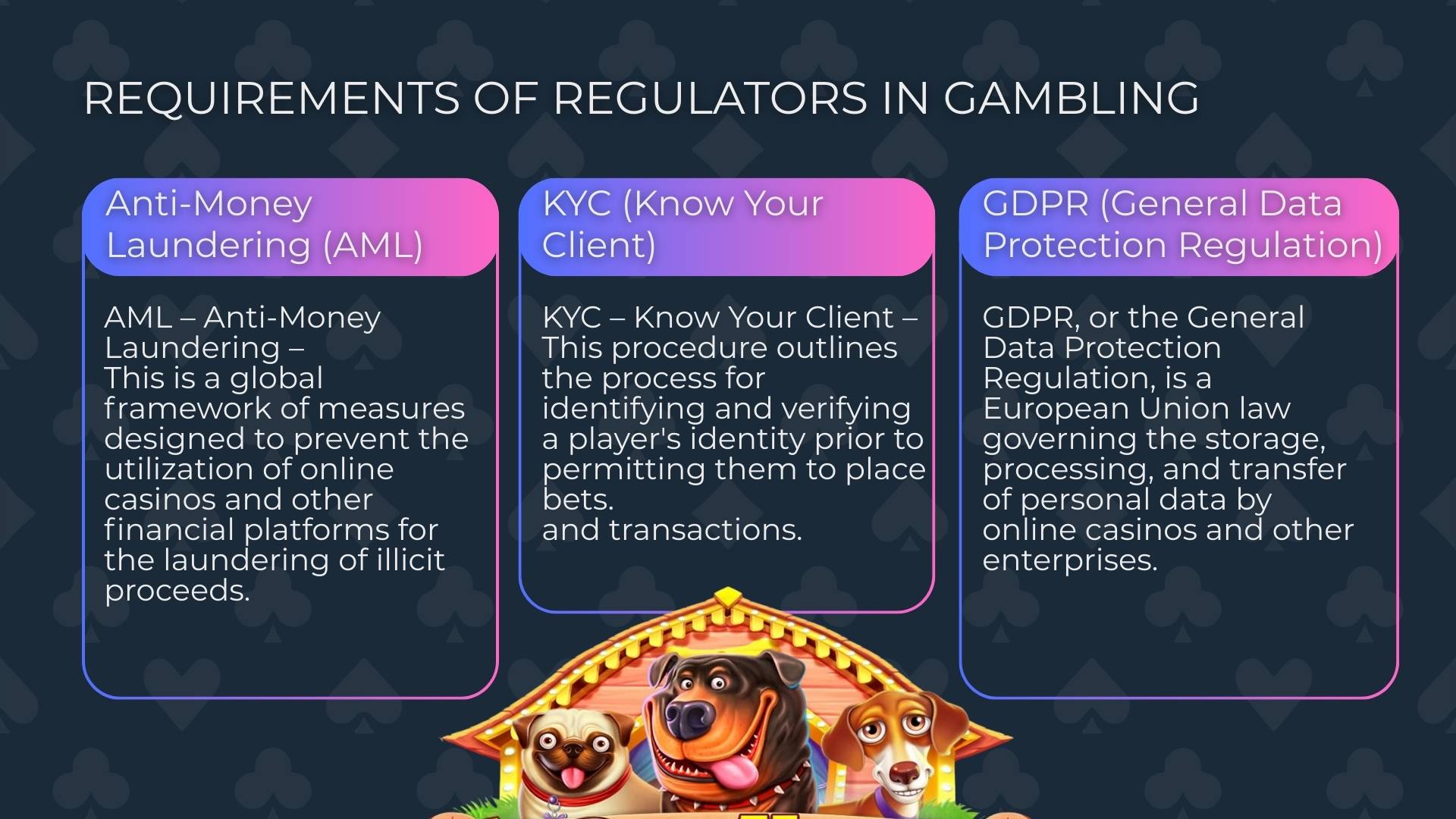

- Regulatory status: licensing requirements and legislative transparency

- Cultural compatibility: player preferences, popularity of game types

- Traffic acquisition cost: competitive intensity across marketing channels

- Level of competition: number of active operators and market saturation

TOP promising countries for iGaming testing in 2025-2026

India

- Market status: partially regulated; some states have legalized online gambling

- Opportunities: vast user base, rapid mobile payments growth, high engagement in fantasy sports and chance-based games

- Risks: unclear legal framework, potential blocks and restrictions

- Optimal model: mobile-first crash games, fantasy sports, stealth marketing, focus on local PSPs

Brazil

- Market status: regulated since late 2023 (online casino and sports betting permitted)

- Opportunities: huge user base, strong engagement, loyalty to online gambling

- Risks: intense competition, volatile tax policy

- Optimal model: full-brand with localization, licensing under new framework, focus on live casino and football betting

South Korea

- Market status: domestic gambling prohibited, but the grey market is sizeable

- Opportunities: high purchasing power, strong interest in live and high-volatility slots

- Risks: blocks, need for anonymous payment solutions

- Optimal model: crypto-casino, anonymous registrations, hidden advertising

Nigeria

- Market status: sports betting regulated; casinos in a grey zone

- Opportunities: young market, rising online payments, high mobile activity

- Risks: unstable economy, weak payment infrastructure

- Optimal model: mobile products with low entry barriers, crash games, airtime and USSD payments

Kazakhstan

- Market status: partially regulated; online gambling still in a grey zone

- Opportunities: strong Telegram traffic, widespread betting habit, high digital adoption

- Risks: blocks and payment gateway challenges

- Optimal model: Telegram-first, crypto-payments, PWAs and mobile lobbies

Philippines

- Market status: regulated by PAGCOR for operators and providers

- Opportunities: mature gambling infrastructure, openness to offshore B2B

- Risks: B2C requires local licensing and corporate registration

- Optimal model: B2B or white-label, regional hub for pan-Asian presence

Peru

- Market status: regulated since 2023

- Opportunities: new regulated market, low competition, high conversion with localization

- Risks: local licensing requirements, 12% tax

- Optimal model: licensed launch, mobile-first approach, SEO focus

Kenya

- Market status: sports betting regulated; casinos partially grey

- Opportunities: young, digital-first market, vigorous mobile traffic

- Risks: legislative volatility, high taxes

- Optimal model: mobile-only, P2P games, crash and bingo, mobile operator billing

Mexico

- Market status: mature, regulated market with licensing regime

- Opportunities: affluent audience, established PSP infrastructure

- Risks: market saturation, need for deep localization

- Optimal model: branded project with SEO and CPA/RevShare affiliate focus

Turkey

- Market status: gambling banned; one of Europe’s largest grey markets

- Opportunities: very high engagement, one of the most lucrative Telegram markets

- Risks: blocks, legal prosecution, security threats

- Optimal model: crypto-casino, Telegram bots, VPN/stealth marketing, high anonymity

|

Country |

Legal Status |

Growth Potential |

Key Risks |

Recommended Launch Model |

|---|---|---|---|---|

|

India |

Partially regulated |

High |

Legal uncertainty, regional disparities |

Mobile-first; fantasy, crash games; local PSPs |

|

Brazil |

Regulated (since 2023) |

Very high |

Regulatory shifts, intense competition |

Licensed brand; full localization; live casino + sports betting |

|

South Korea |

Grey market |

High |

Strict restrictions, blocks, reputational risks |

Crypto-casino; anonymity; high-volatility products |

|

Nigeria |

Partially regulated |

Medium |

Unstable economy, weak payment infrastructure |

Mobile-only; crash games; airtime & USSD payments |

|

Kazakhstan |

Grey market |

Medium |

PSP limitations, technical blocks |

Telegram-first; PWA; crypto-payments |

|

Philippines |

Regulated (PAGCOR) |

High |

Bureaucratic barriers for B2C |

B2B/white-label; offshore operational hub |

|

Peru |

Regulated (since 2023) |

Medium |

Licensing costs, 12% taxation |

Local brand; SEO; mobile-first |

|

Kenya |

Partially regulated |

Medium |

High taxes, legislative volatility |

Mobile-only; crash games; micropayments |

|

Mexico |

Regulated |

High |

Saturation, deep localization requirements |

SEO-first; localized brand; CPA/RevShare affiliates |

|

Turkey |

Banned (grey market) |

High |

Regulatory risks, blocks, legal vulnerability |

Crypto-casino; Telegram; VPN; stealth marketing |

How to test geo without serious costs: white-label as the basis of an agile strategy

Testing new geo always hinges on speed, flexibility, and cost reduction. Under legal uncertainty, complex localization, and high full-launch costs, white-label platforms are the optimal choice. They enable a rapid product launch without upfront investment in development or infrastructure.

Why is white-label a strategic choice rather than a budget one?

- Integration with payment systems, including alternative PSPs

- Connections to game providers, live and crash content

- Technical support and hosting

- Built-in marketing and analytics tools

Conclusions and strategic recommendations

The analysis of global iGaming geos for 2025–2026 shows the industry’s shift toward diversified growth, where an operator’s success hinges on the quality of geo-intelligence decisions. With regulatory pressure mounting in mature European markets and acquisition costs soaring, operators are increasingly eyeing emerging and transitional economies, where market potential far exceeds current online gambling penetration.

-

Emerging geographies (Brazil, Nigeria, India) offer low competition, broad untapped audiences, and strong brand loyalty when properly localized. These regions enable organic growth and a loyal customer base without spending millions on traffic in overheated PPC markets.

-

Cultural and linguistic sensitivity is paramount. Local game formats (e.g., Teen Patti in India, fantasy sports in Brazil, live games in Southeast Asia) improve product-market fit and reduce bounce rates. Universal European marketing models often fail in geos with different user habits and digital behaviours.

-

Comprehensive risk assessment is essential, focusing on:

-

Political-legal instability (Nigeria, Philippines)

-

Opaque or contradictory regulation (India)

-

Restrictions on traditional payment systems (Kazakhstan, Turkey)

-

Potential changes in taxation and licensing (Brazil)

-

Geo-intelligence in iGaming for 2025–2026 is not about chasing “green zones,” but about a managed-risk strategy. Winners are not those who enter first, but those who enter consciously: adapting their product, minimizing legal threats, precisely calculating unit economics, and investing in local expertise. Such operators build durable competitive advantages and sustainable operational models.